Each month we release improvements, new features and bug fixes to MYOB Business. Listed below are releases from previous months. If you want to find out about more recent releases, see what's new in MYOB Business.

2025

October 2025

MYOB Assist mobile app

Australia only

We're refining the app to make it even easier to use:

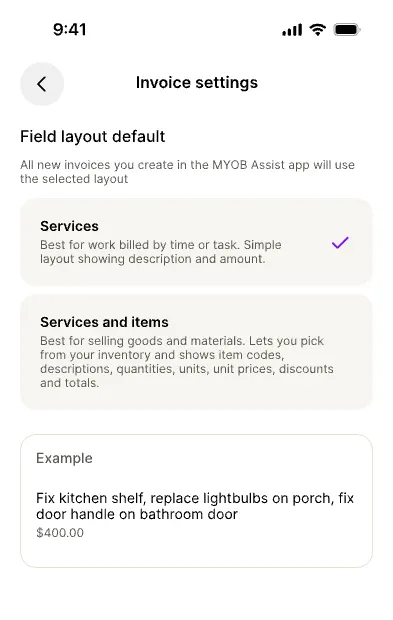

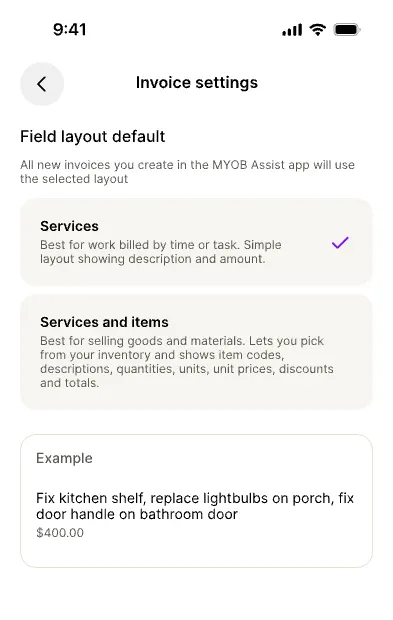

Introducing Service invoices

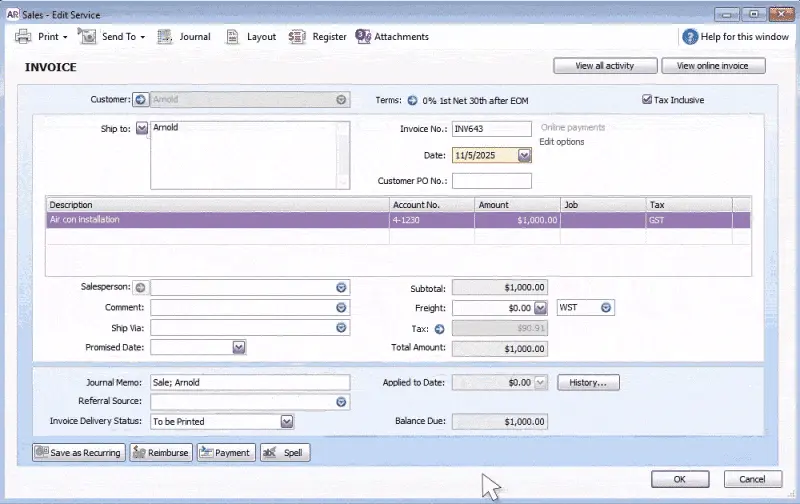

If your business provides services rather than products, you can now choose a Service layout when creating an invoice. This layout is designed for service-based work, where you bill for time, labour, or descriptions of work instead of items or quantities. These invoices are editable within AccountRight browser and MYOB Business.

Set your default invoice layout (Services or Services & Items) from the More menu.

(Online invoicing users) Send invoices with a payment link via SMS

If you use online payments, you can now send your customers a secure payment link by SMS — not just a PDF attachment. This makes it easier for customers to view and pay directly from their phone. You can send the SMS from the Save menu or by turning on the SMS option when emailing an invoice.

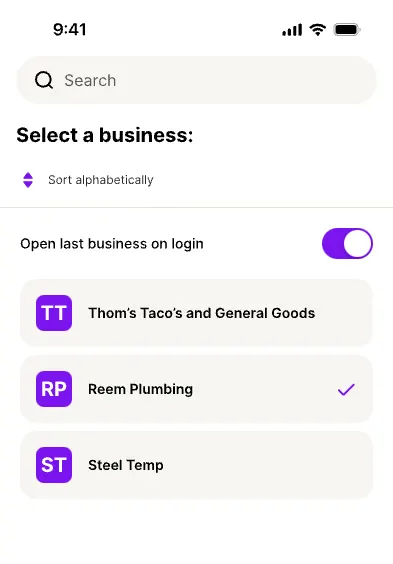

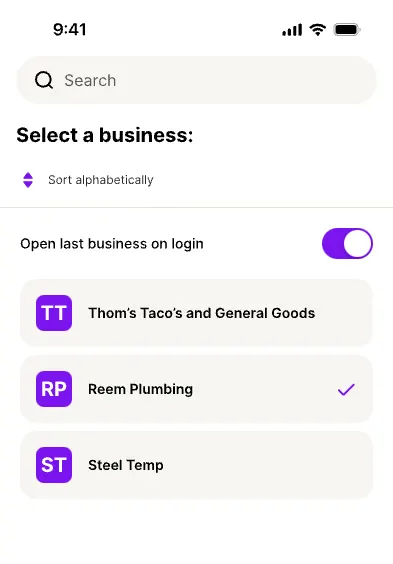

Automatically open your last business file

Save time every time you log in — the app now remembers the last business file you used and opens it automatically. If you usually work from one business file, you no longer need to select it from the list each time you sign in. Just select Open last business on login on the Switch business page, and each time you log in, you’ll go straight into the business file you last used.

You can still switch files anytime from More > Switch business..

MYOB Business bug fixes

We fixed an issue that could cause errors and poor performance when categorising transactions on the Bank transactions page.

We fixed a bug that could result in duplicate transactions when bank transfers are automatically matched.

September

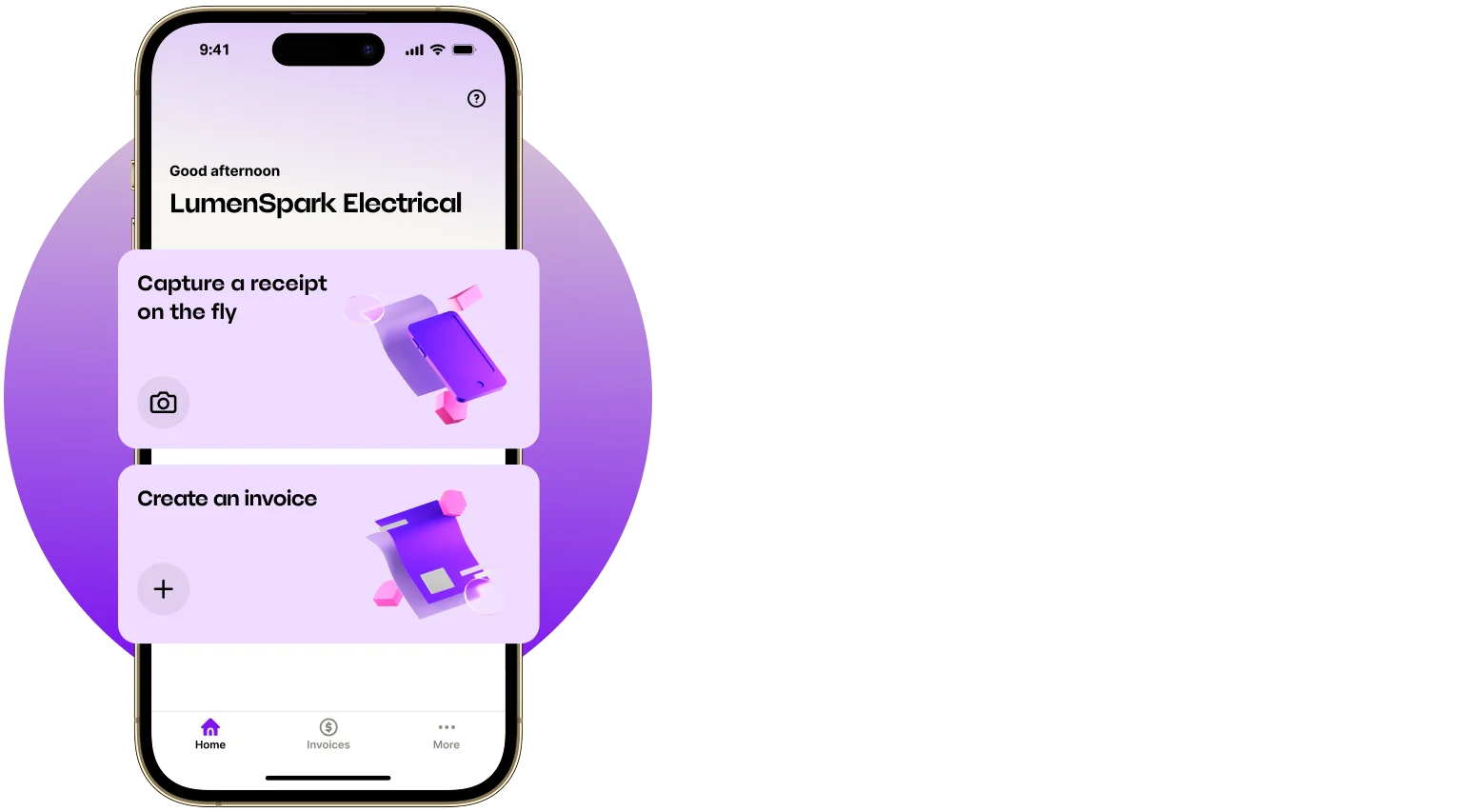

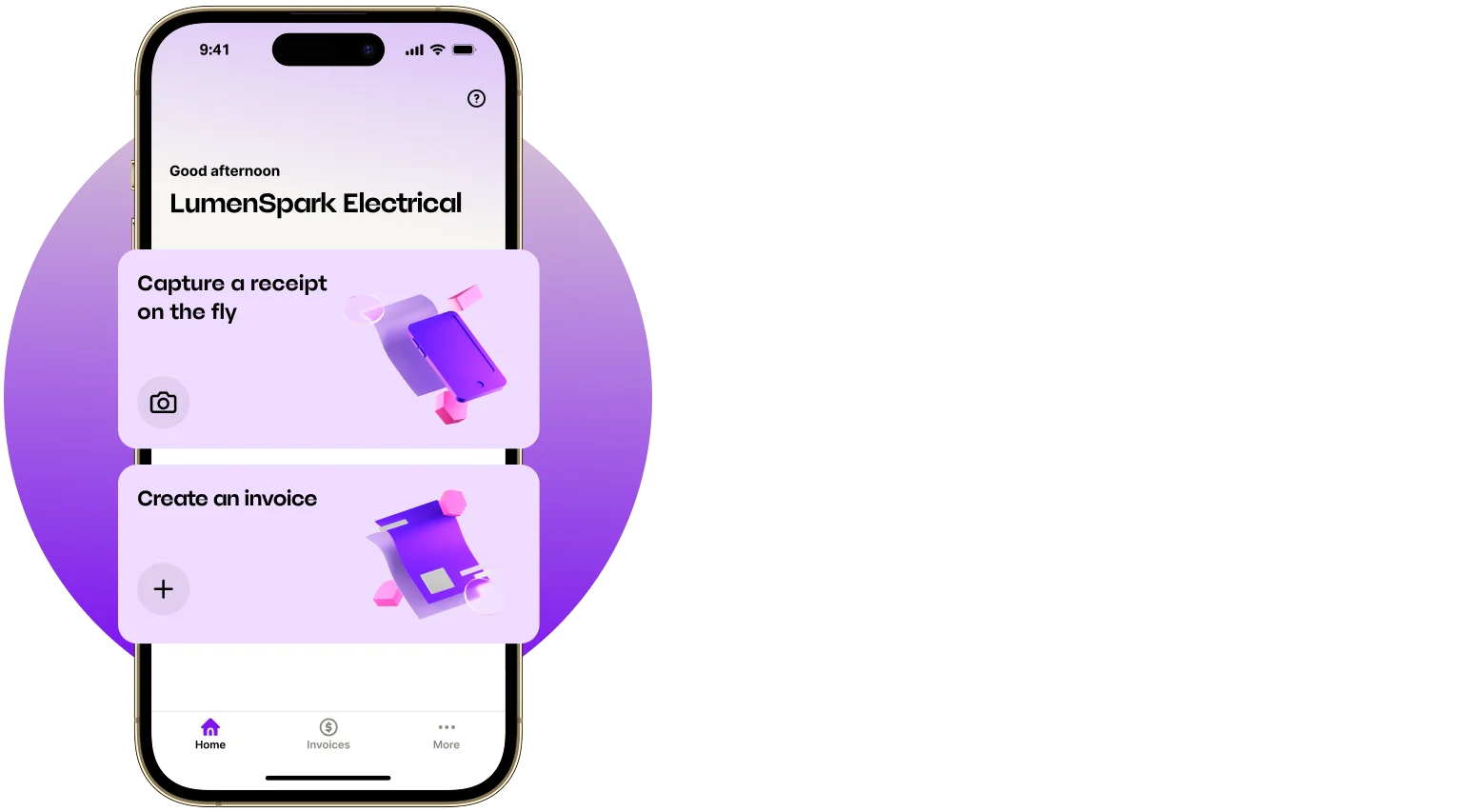

The MYOB Assist mobile app is here (Australia)

This app is now live in Australia and replaces the existing MYOB Capture and Invoice apps. MYOB Assist helps you to unlock better cash flow. With the new app, you can:

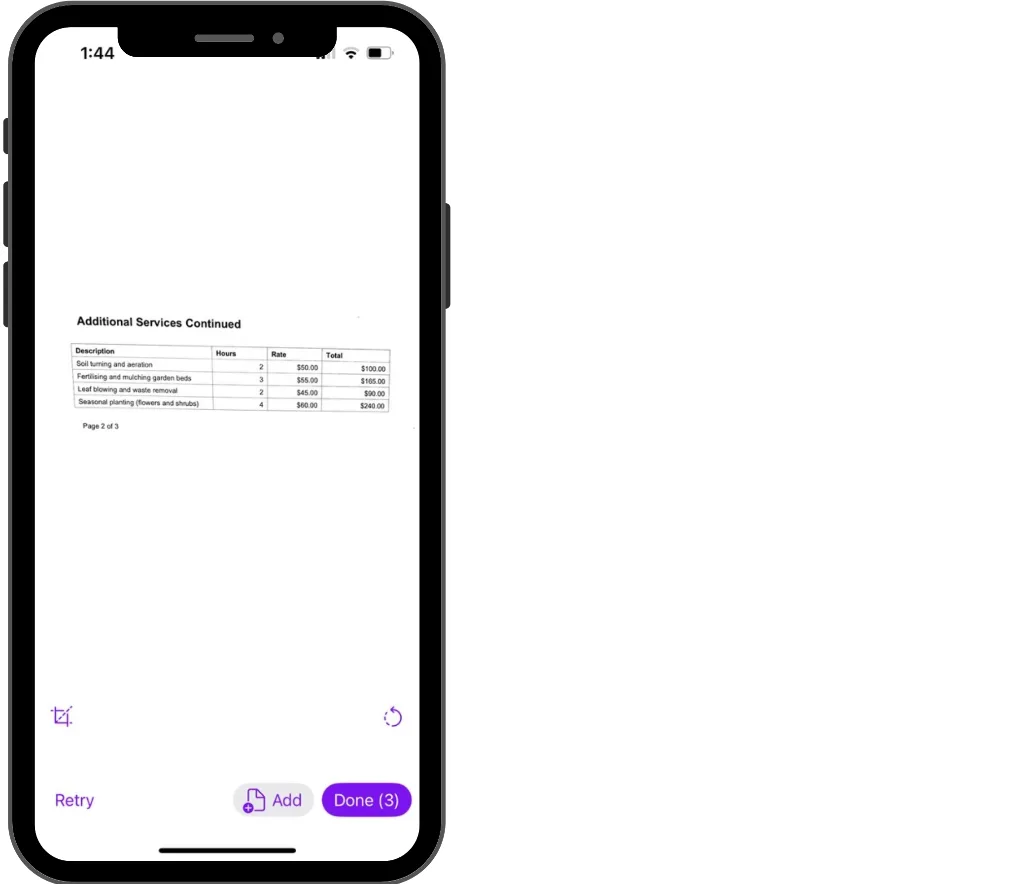

Capture expenses – snap a photo of a bill or receipt and send it straight to your MYOB Business Uploads (or the In Tray for online AccountRight files). Capture single or multi-page documents (up to 20 pages), ready for uploading.

Create invoices – create, edit and send professional invoices in just a few taps – all synced in real-time with your online company file.

Banking

Smarter suggestions

We've improved the suggested matches on the Bank transactions page to make it quicker and easier to match your invoices and bills. MYOB Business now looks for full names in transaction descriptions, not just parts of names, so you get more accurate suggestions.

Improved auto-matching

Auto-matching no longer happens if the date of an MYOB transaction is later than the bank transaction date. Instead, you'll now see a suggestion.

Faster transaction allocation

We've made some performance improvements so that you can allocate transactions line by line faster using hot keys or moving quickly down the page.

Less clutter

We've removed some annoying success messages from the Bank transactions page so you can work with fewer disruptions.

August

Payroll (Australia)

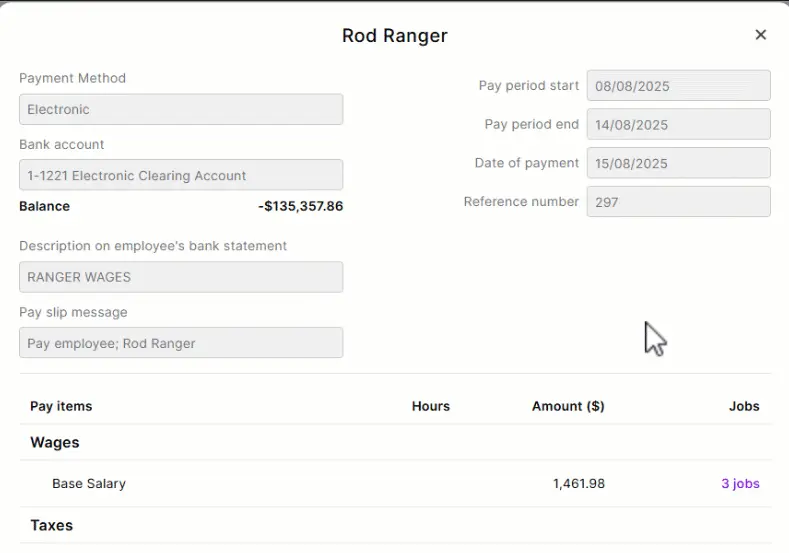

See jobs in past pay runs

When you look at an employee's previous pay, you'll now see if any jobs were assigned and the job allocation.

Banking (New Zealand)

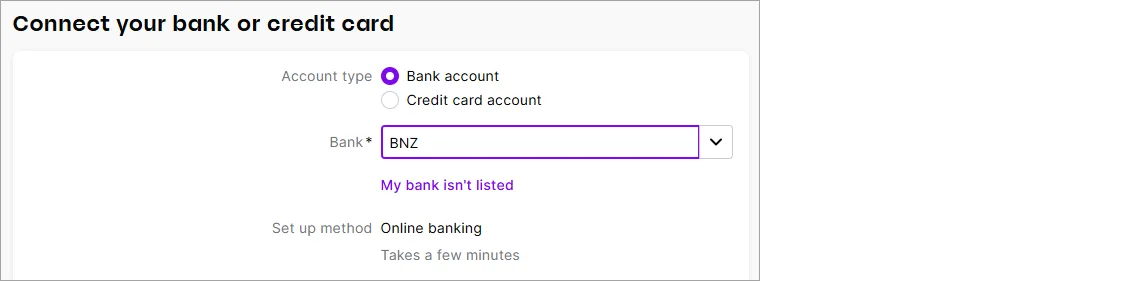

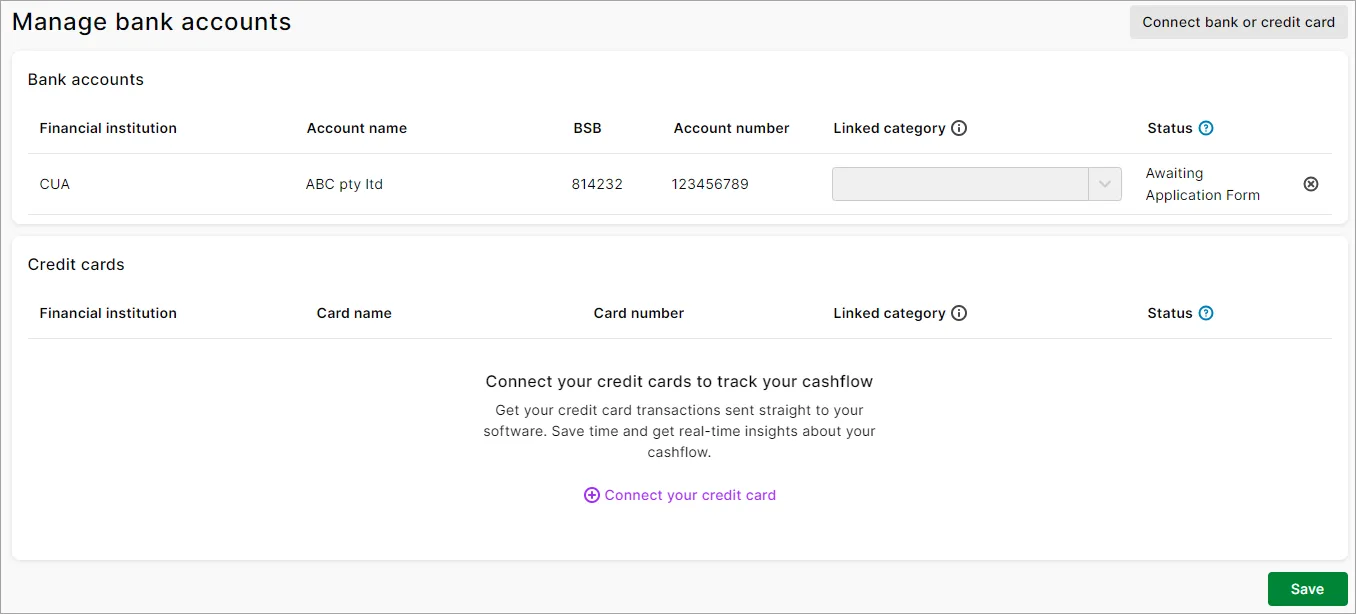

Quicker setup of BNZ bank feeds

BNZ improved how their bank and credit card accounts connect to MYOB. This means you can now connect a BNZ account to MYOB Business faster by applying online. Previously you needed to fill in and submit an application form. Connect a BNZ account

July

Banking

Save time with a smarter Bank transactions page

We’re gradually rolling out changes to the Bank transactions page to make matching faster, smarter and less manual. If you don’t see these changes yet, they’re not far away:

Category suggestions save you time and guesswork MYOB Business uses artificial intelligence to learn from how you previously matched a transaction to a category to suggest a matching category the next time a similar transaction comes in. This saves you from searching for a category to match it to.

You can accept the suggestion with one click (or easily choose another category from the list).

When you accept a category, MYOB Business creates the matching transaction record for you.

Simpler teminology With the introduction of category suggestions, we’ve replaced ‘categorising’ with ‘matching’. Now, you match bank transactions to a category.

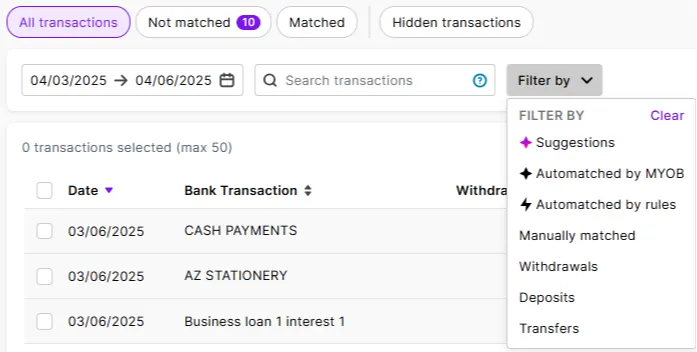

Better searching We’ve simplified and improved the search filters. Use the Not matched filter to show all bank transactions waiting to be matched. You can also filter the transaction list by suggestions, automatches, or transaction types.

These changes are still being rolled out to all businesses, but here's how you work with the new design.

More reliable bank feed delivery times

The daily delivery of transactions from your connected bank accounts now happens by 11am each morning (Melbourne time). This gives you up-to-date banking data sooner, so you (or your automated bank rules) can take care of matching and categorising earlier.

June

Payroll

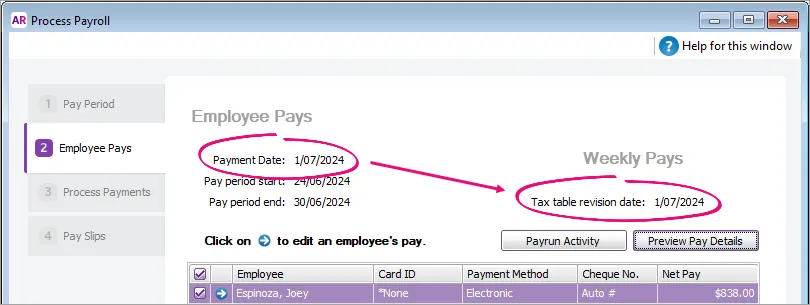

Reminder: Helping you stay compliant for the 25/26 payroll year (Australia only)

As we mentioned last month, we've taken care of all these changes for the 2025/26 payroll year:

Tax tables – the 2025/26 tax tables have been automatically updated and will apply for pays dated 1 July 2025 onwards. You'll see the new tax table date in your General payroll information after processing your first July pay (settings (⚙️) menu > Payroll settings > General payroll information tab).

Super rate increase to 12% – the super guarantee rate has gone up to 12% from 1 July, but there's an easy way to make sure this increase happens automatically.

Lump sum E threshold removal – From 1 July, any payment of back pay is considered a lump sum E. Previously this only applied to back pay exceeding $1200.

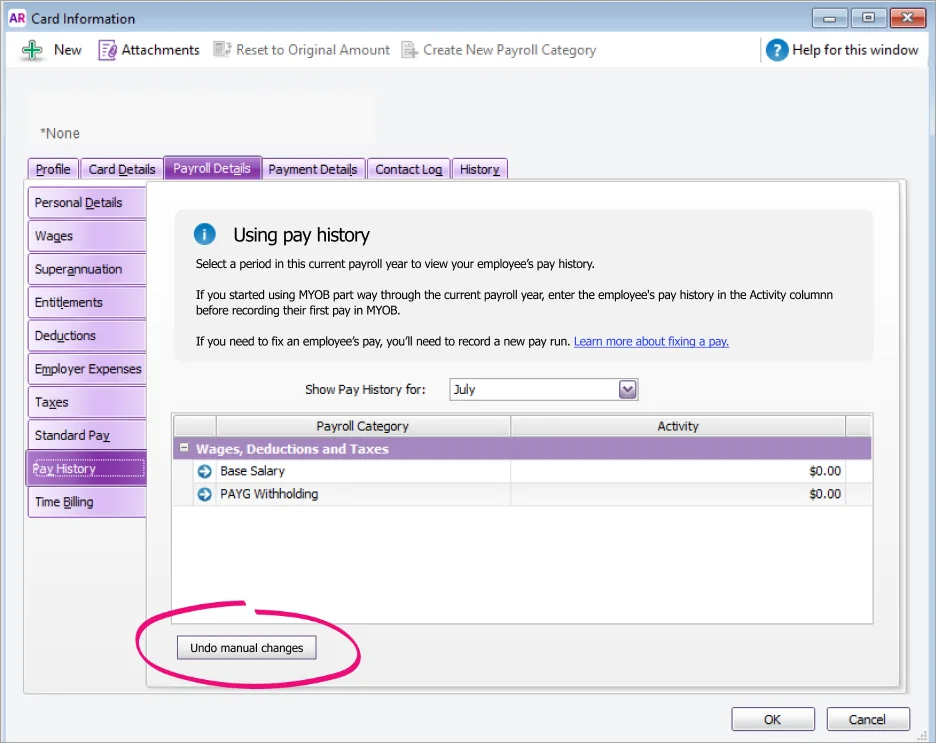

Undo manual changes to pay history (Australia only)

An employee's pay history shows what they've been paid in pay runs, so should never be tampered with. We've added the ability to Undo manual changes in an employee's Pay history to easily remove any changes that have been entered manually (maybe trying to fix a pay). Previously you needed to contact us for help to undo these changes.

New workers compensation report (Australia only)

We're adding a new report that helps prepare wage estimates and declarations required by workers compensation providers. Use the report to generate the payroll information needed when starting or renewing a workers compensation policy. You'll find the report via the Reporting menu > Reports > Payroll tab.

Account management

Easier MYOB account update processes

We've made it easier to update the relationship your business has with MYOB, whether you want to:

Clearer change of details forms and help topics guide you through what to do and what supporting documents you may need to provide.

Bug fixes

We fixed a bug that was preventing the tax amount from showing on general journal transactions in the General ledger report.

May

Payroll

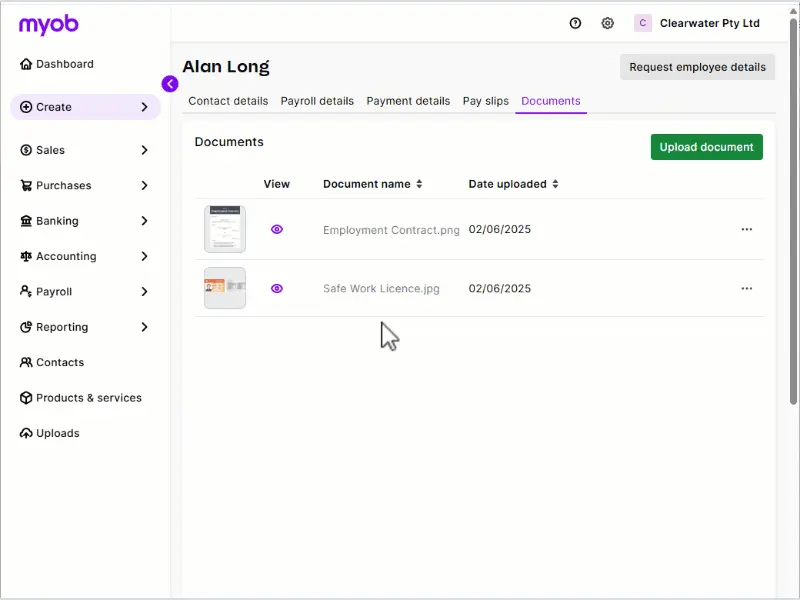

Upload employee documents to stay organised

Store documents, like contracts, licences or certificates, in MYOB Business. This keeps all your employee information safely stored in one place where it's easily accessible. More about storing documents

Helping you stay compliant for the 25/26 payroll year (Australia only)

We've got you covered this EOFY by taking care of all these changes for the 2025/26 payroll year:

Tax tables – the 2025/26 tax tables have been automatically updated and will apply for pays dated 1 July 2025 onwards. You'll see the new tax table date in your General payroll information after processing your first July pay (settings (⚙️) menu > Payroll settings > General payroll information tab).

Super rate increase to 12% – the super guarantee rate goes up to 12% from 1 July, but there's an easy way to make sure this increase happens automatically.

Lump sum E threshold removal – From 1 July, any payment of back pay is considered a lump sum E. Previously this only applied to back pay exceeding $1200.

Improved compliance for self-managed super funds (Australia only)

To pay contributions to a self-managed super fund (SMSF) from MYOB, your STP reports must have been successfully accepted by the ATO. This confirms your business is verified with the ATO and helps ensure SMSF payments are only made by legitimate, registered employers.

Banking

More matches, less admin with smart transaction matching (Early Access Program)

An early access program (EAP) has been launched for changes to the Bank transactions page to make matching faster, smarter and far less manual. A small cohort has been added to the EAP to try this new feature before it's rolled out to everyone.

AI smart-matching – AI will automatically suggest the best match for existing MYOB records or categories. If there's more than one suggestion, select a match, or multiple, from a list of suggestions. AI predictive learning means matching will improve over time based on your behaviour.

"Categorised" is now "matched" – We've simplified how we talk about matching. Bank transactions are now matched to an existing MYOB transaction or matched to a category.

Bug fixes

We fixed a bug that was preventing some users from seeing the dashboard. Previously, users with the Purchases, Banking or Contacts roles were seeing an error stating "You don't have permission to access this page."

April

Payroll

Simplifying STP compliance (Australia only)

When you create a new MYOB Business file, the ATO Reporting Category is now set for you in these pay items:

Base Hourly

Base Salary

Annual Leave Pay

Personal Leave Pay

Overtime (1.5)

Overtime (2x)

This speeds up STP setup and prevents these payments from being reported incorrectly to the ATO.

Helping you stay compliant with super calculations (Australia only)

When you set up a new type of wage payment, like a new allowance, there's a new option to exclude those payments from super guarantee calculations. To help you choose, there's some handy info – just click the blue question mark.

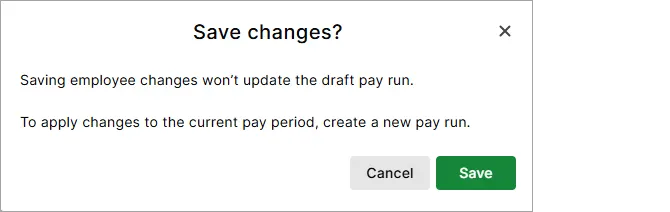

No longer lose a draft pay run when you update an employee (New Zealand only)

If you save changes to an employee who's included in a saved (draft) pay run, the draft pay run is no longer deleted. Instead, after saving the changes (which won't be reflected in the draft pay run), you'll see a message that explains it. It's then up to you whether you continue the draft pay run or create a new one. More about saving and resuming pay runs

Performance improvements

Smarter handling of uploaded documents

We're improving the Optical Character Recognition (OCR) that scans uploaded invoices and receipts to create new bills in MYOB Business. This improves the accuracy and processing times for uploads.

A fresh new colour

We've tweaked the purple colour you'll see in our logo and on images and buttons throughout MYOB Business.

March

Payroll

Helping you stay compliant for the 25/26 payroll year (New Zealand only)

We've updated the required rates and thresholds to keep you in the good books with Inland Revenue (and your employees) for the new payroll year. There's a change to the way extra payments are taxed – and we look after this for you too. See what's changed from 1 April.

More flexible pay distribution (New Zealand only)

You can now split an employee's pay across up to three bank accounts. This gives your employees more control over their funds. An employee can choose to split their pay by amount or percentage and they'll see the split on their pay slip. More about splitting pays.

Sales

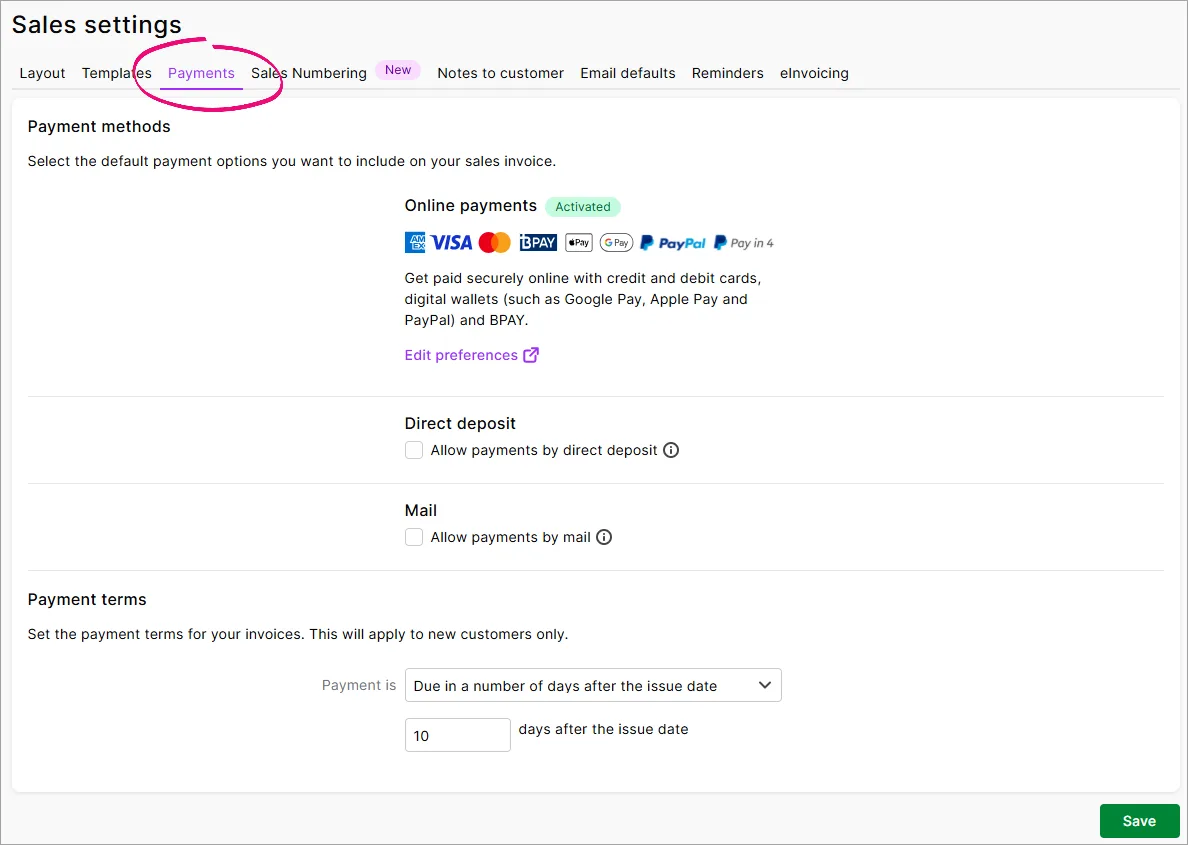

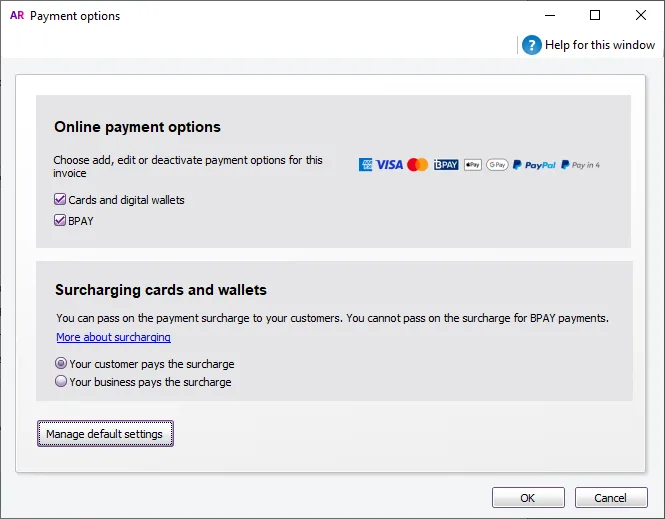

Quicker access to online payment settings (Australia only)

Online payments in a popular feature that helps you get paid faster. So we've moved the online payment settings from the bottom to the top of the Payments tab in your Sales settings. This makes it easier to set up and manage online payments. More about online payments

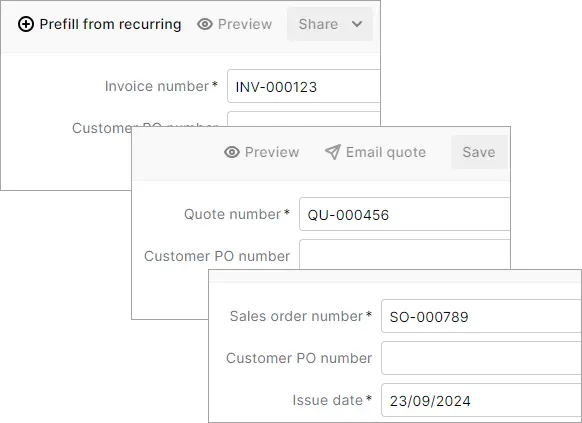

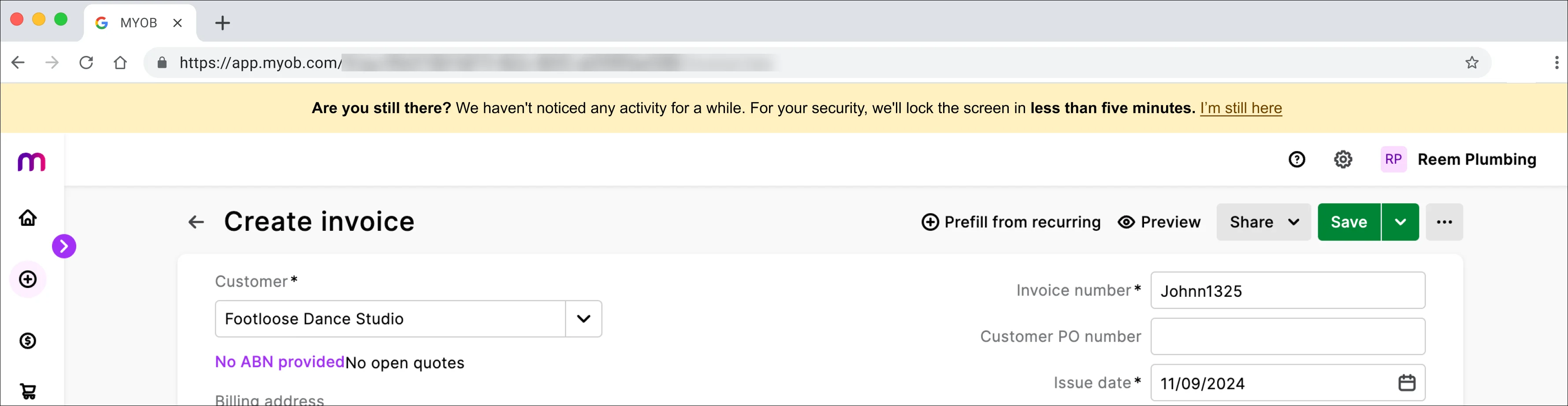

Easier to identify different types of sales

AccountRight browser only

We released this for MYOB Business Pro and Lite last December and it's now available for AccountRight users accessing their online file in a browser. You can set up a different prefix and numbering sequence for your invoices, quotes and sales orders.

Bug fixes

We fixed an issue in the Job profit and loss report that was causing the error "Failed to load the report".

February

Payroll

Helping you stay compliant with Single Touch Payroll Phase 2 (Australia only)

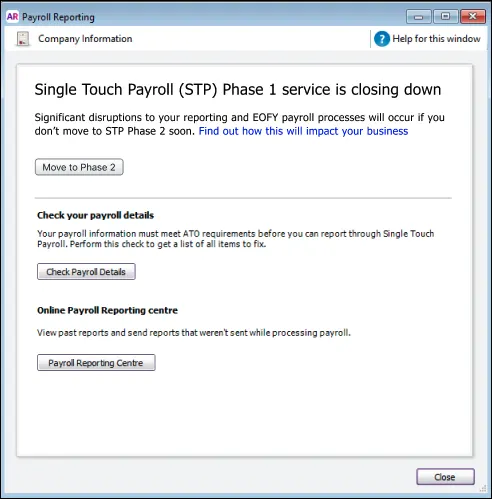

STP Phase 1 was switched off 27 February. So, if you haven't switched to STP Phase 2, you need to do so now to continue reporting to the ATO. How to move

See outstanding PAYG withholding at a glance (Australia only)

There's a new widget on the dashboard that shows how much PAYG tax you've withheld from employee pays. This handy snapshot means you no longer need to go searching for this info when it's time to lodge your BAS.

Suppliers

Wise bank account numbers are now supported for suppliers (New Zealand only)

You can now enter a Wise bank account number in the supplier's contact record.

Invoicing

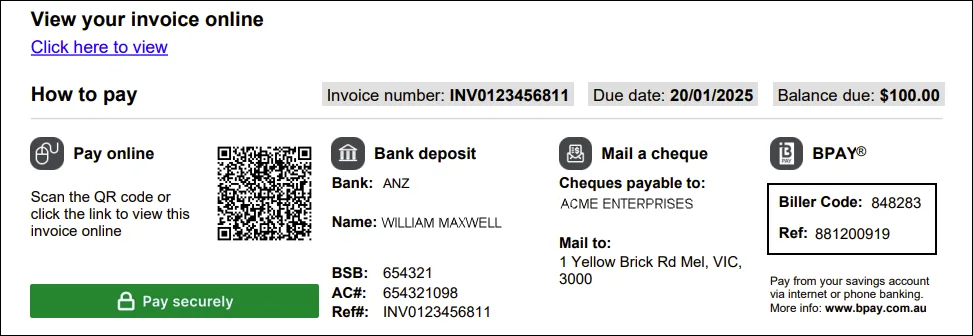

Get paid faster

Payment methods, like bank deposit and cheque, are now shown on customer's statements, making it easier for them to pay your invoices.

(Online Payments, Australia only) More control over payment methods

You can now enable or disable BPAY payments on recurring invoices.

Bug fixes

We fixed an issue where the bank reconciliation would freeze when trying to reconcile too many transactions. You'll now see a helpful message telling you to choose an earlier reconciliation date to reduce the number of transactions.

January

Payroll

Quicker employee setup (New Zealand only)

If your business is set up for payday filing, new employee details are now automatically sent to Inland Revenue. This means you no longer have to also set up new employees in your myIR portal. There's a new tab in the Payday filing page to see your employee submissions. More about sending employee details to IR.

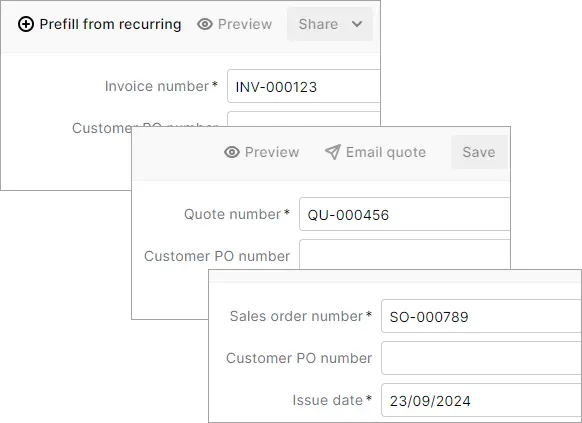

Security

Helpful nudge in reports before screen locks saves you having to sign back in

Five minutes before the inactivity screen lock, a message will appear at the top of any report you have open. This gives you a chance to resume working before the screen locks.

Banking

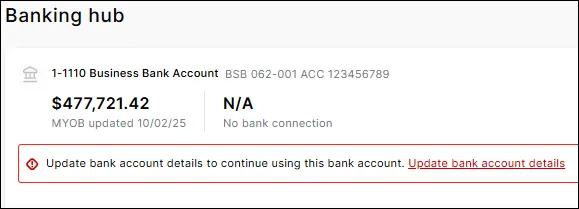

Helping you keep bank details up to date

You'll now see reminders in the Banking hub if any details are missing for your bank accounts, like the financial institution. This helps to keep your account details up to date and provides better visibility of your bank accounts in the one place.

Connect your Great Southern Bank Business + accounts (Australia only)

If you have a Great Southern Bank Business + account, you can now set up bank feeds for it in MYOB Business. You can apply via your internet banking. How to apply

2024

December

Security

Helpful nudge before screen locks saves you having to sign back in

Five minutes before the inactivity screen lock, a message will appear at the top of any tab you have open. This gives you a chance to resume working before the screen locks:

Sales

Easier to identify different types of sales

MYOB Business Pro and Lite only

You can set up a different prefix and numbering sequence for your invoices, quotes and sales orders.

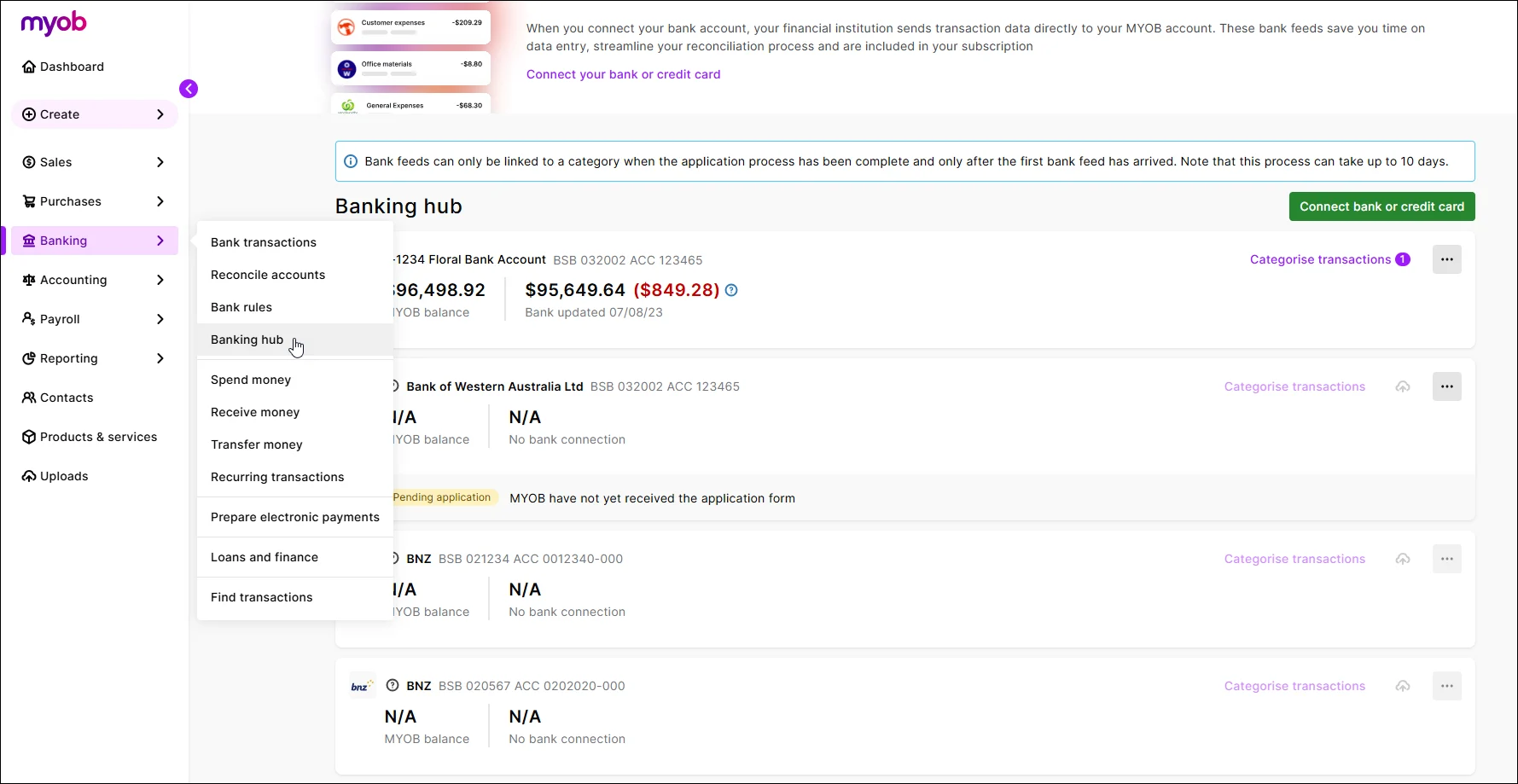

Banking

Smarter auto-matching of money transfers

If you transfer money from one account to another, the bank transaction will now be automatically matched to the relevant MYOB Business transaction.

Easily reconnect BNZ bank feeds

AccountRight browser users, New Zealand only

BNZ have changed their bank feeds to use a new API-based system. So you can continue using your BNZ bank feeds, we've released the ability to reconnect them.

Store more details about your bank accounts

When you create a new category that is a bank account type, you can now indicate what the account is for, like a savings account, and the financial institution. If you haven't entered these details for a bank account, you'll see a reminder in the Banking hub.

November

Security

Keeping your data safe when you're not around

Online data security is a big deal – so after 20-30 minutes of inactivity in MYOB Business, the screen will lock and become blurred. This prevents unauthorised access (and prying eyes) from your valuable business data. To keep working, just sign back in. More about the inactivity screen lock

Banking

One-stop shop for staying on top of your banking

The Banking hub is your starting point to make sure that your books reflect what's really going on in your accounts. Connect a bank account, manage your bank feeds and see if there are any bank transactions you need to categorise. This replaces the Manage bank accounts page. More about the Banking hub

Smarter auto-matching of refunds

If you give or receive a refund from a customer or supplier, the bank transaction will now be automatically matched to the relevant MYOB Business transaction.

October

Payroll

Helping you stay compliant with Single Touch Payroll Phase 2

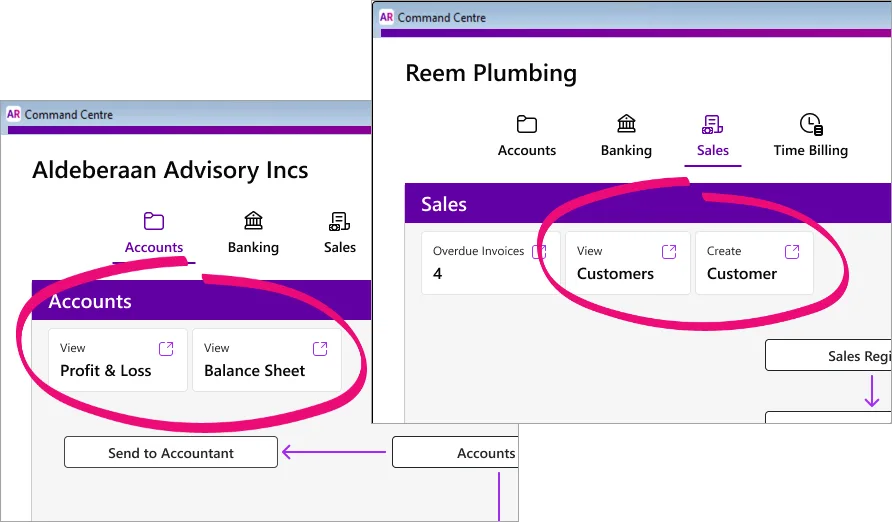

If you still report payroll using Single Touch Payroll Phase 1, you'll receive a reminder that STP Phase 1 is being retired and you'll need to move to STP Phase 2, including a link for more information:

Banking

Smarter auto-matching of supplier bills

We've improved bank feed automatic matching to use the supplier invoice number in the bank transaction description to match the supplier invoice number entered in the bill payment in MYOB.

Business logo on new files

Making sure your new business file reflects your brand

You're now prompted to add your business logo via settings (⚙️) > Business settings > Brand settings when you start using a new MYOB Business file. This lets you communicate your brand and business details on your invoices, quotes and statements as well as brand your business reports. More about uploading a logo to represent your brand

Usability improvements

Sensible default when creating a new supplier

When you create a new supplier, the option to designate them as a Company or Individual is now selected as Company by default. This reflects that most suppliers are companies.

Bug fixes

Fixed an issue that prevented all lines in a general journal transaction appearing as possible matches in the Bank transaction page > Match transaction tab.

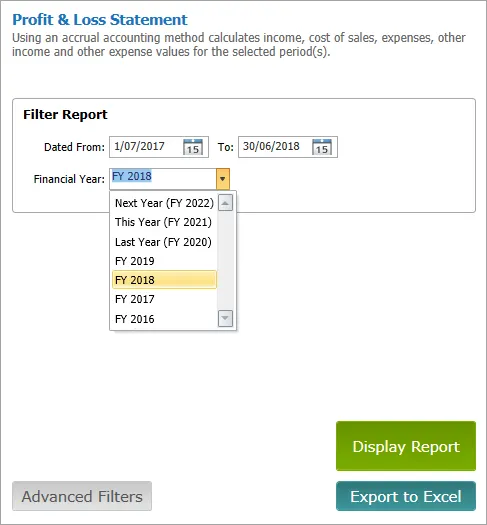

When you select Budget as a report option in the Profit and loss report, the figures in the Budget column are now aligned.

September

Security

Helping you keep your online data safer

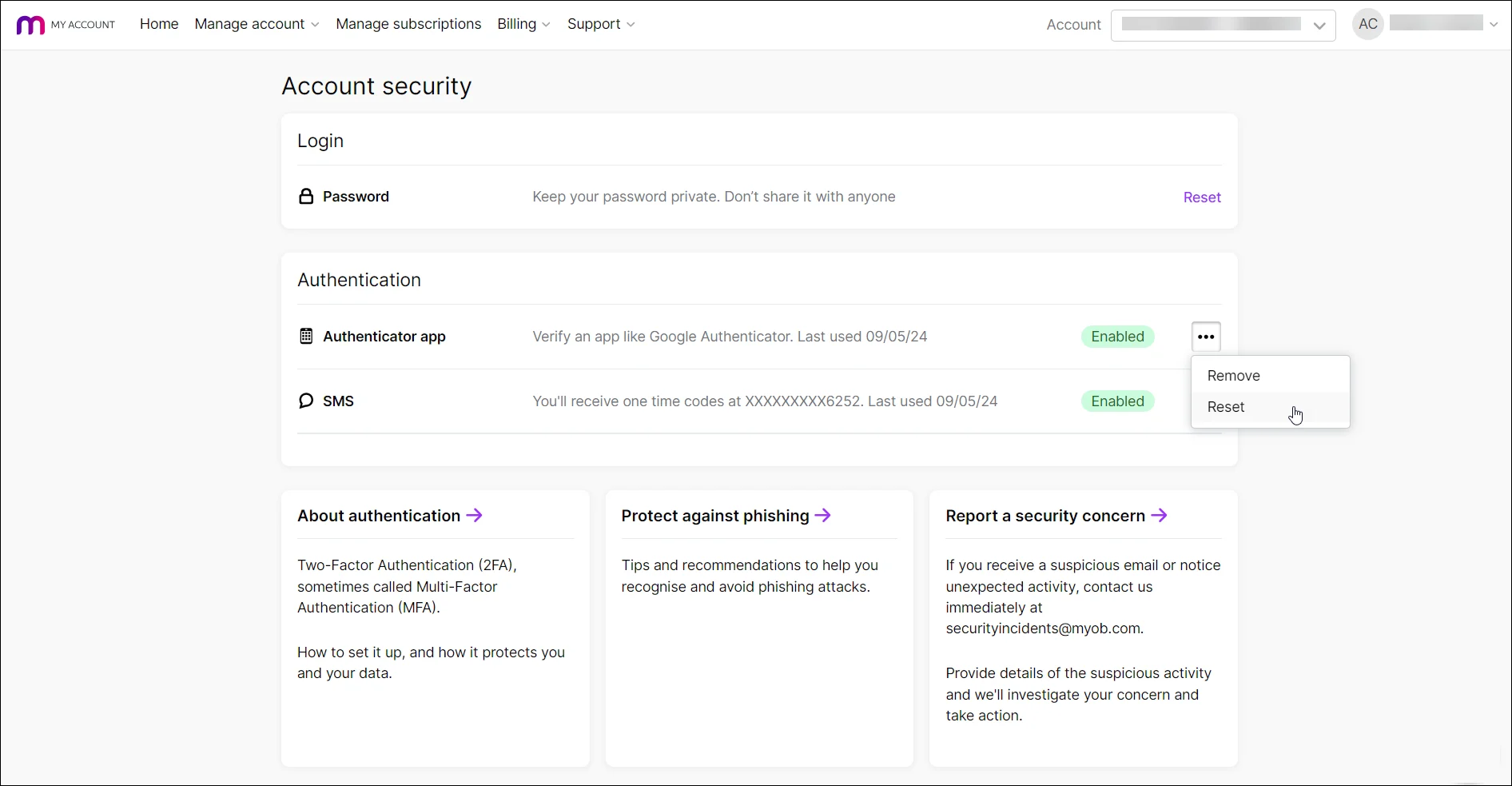

Two-factor authentication (2FA) is a key way we keep your data safe. To meet the latest security challenges, we've removed the option to remember your device for 30 days when entering a 2FA code. Instead, you'll now need to sign in and enter a 2FA code at least once every 24 hours. So, if you work in MYOB Business daily, you now need to sign in and complete the 2FA check each day. More about security improvements.

Payroll

Helping you stay compliant with super guarantee rules

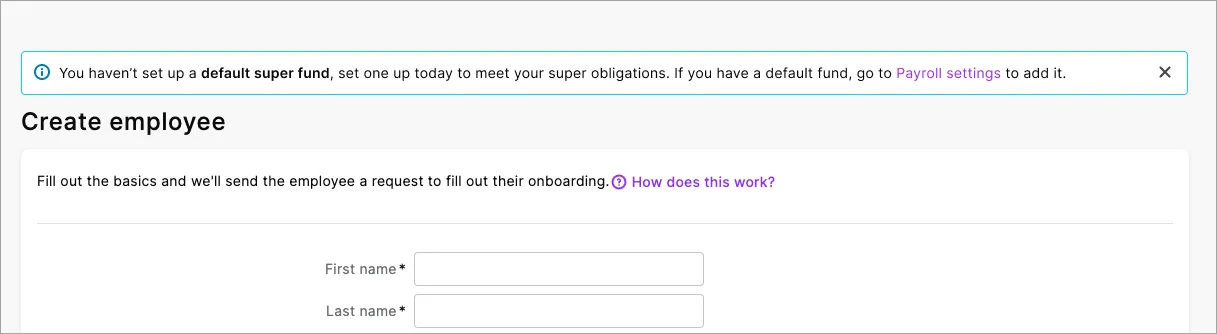

The ATO requires every business to have a default super fund. If you don't have one set in MYOB Business, when you send a new employee a self-onboarding request you'll now see a more prominent message to set your default super fund.

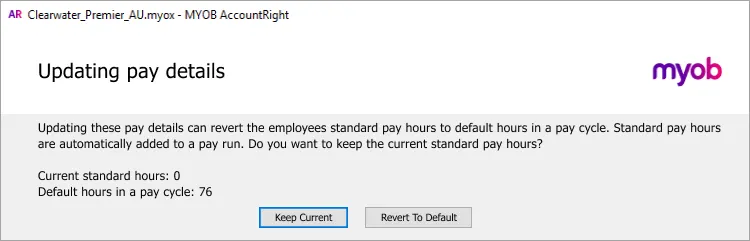

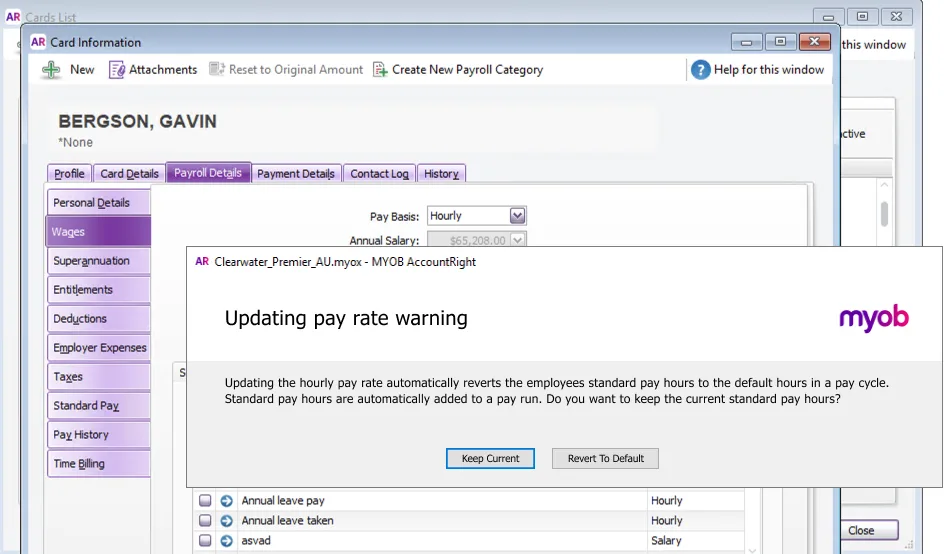

More control when updating hourly employees

When you update an hourly employee's pay rate or pay cycle and it affects their standard pay hours, you can now choose to revert or keep their current standard pay hours. For example, if you've set their standard pay hours to 0 (because they're a casual employee with varying hours), you can keep this if you change their pay cycle.

Bug fixes

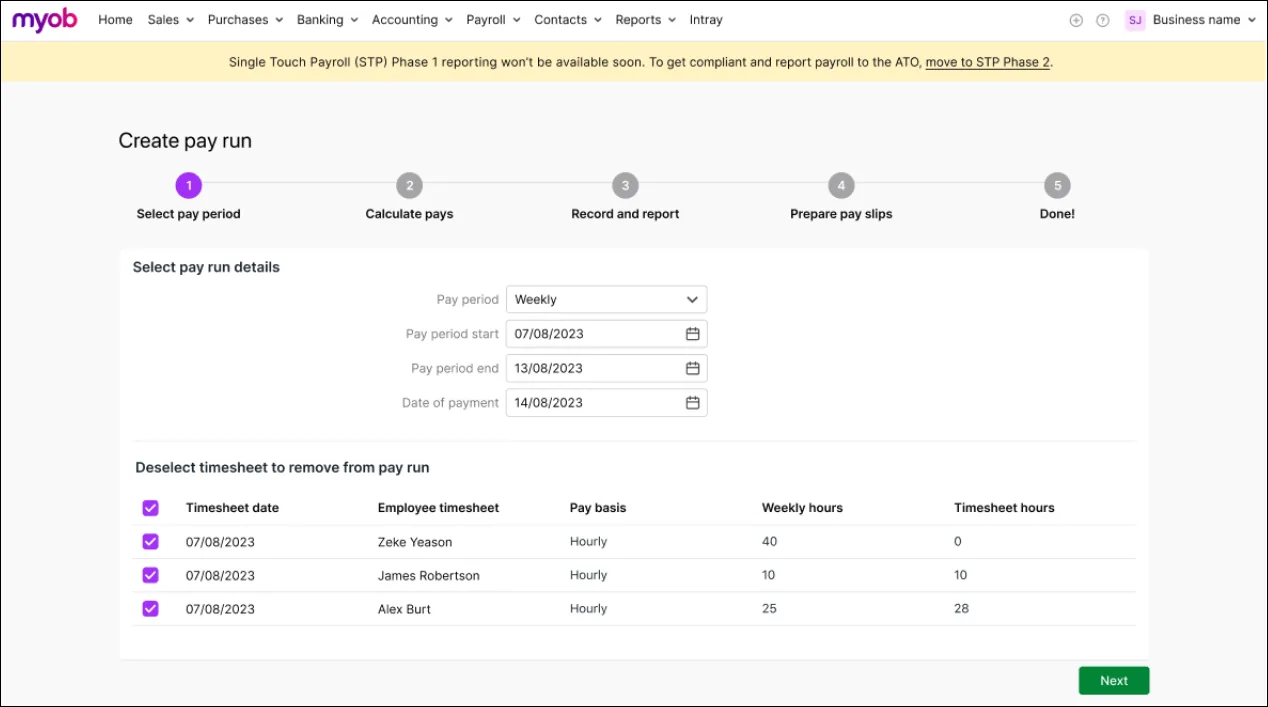

Unprocessed timesheets are now automatically listed when you start a new pay run. Previously, you had to re-enter the Date of payment in the pay run to make them appear.

We fixed an issue where bank feed transactions were not appearing in AccountRight desktop but they were still appearing in the browser. Bank feeds are now consistently appearing in both the desktop and browser.

We fixed an issue that could have caused an out of balance in the General ledger report. Previously, a debit and a credit posted to the same category sometimes showed incorrectly as a one sided entry.

August

Payroll

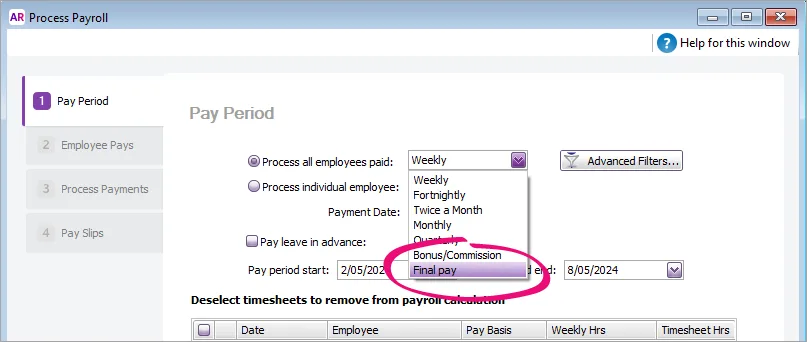

Even easier final pays

Previously, we released the ability to pay unused annual leave in an employee's final pay. Now, you can also pay unused long service leave for employees who are leaving voluntarily. More about final pays.

Sales

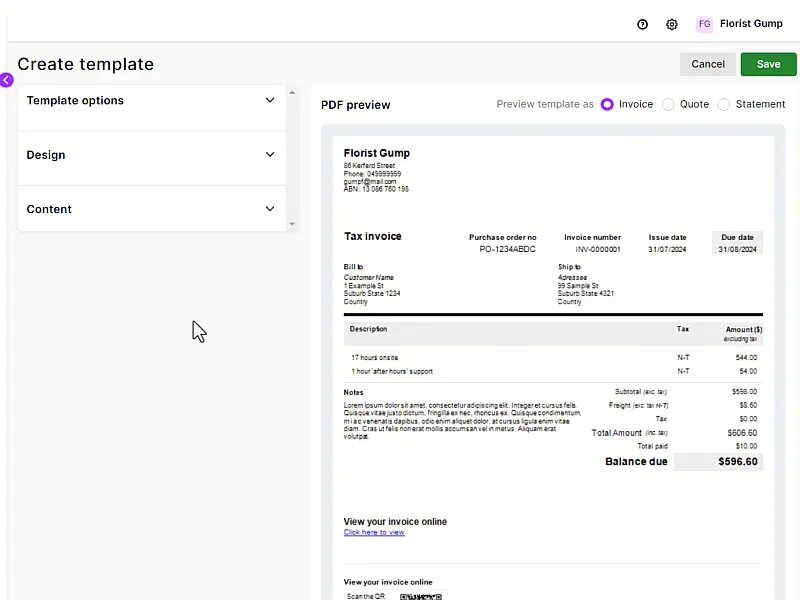

More invoice customisation

Change the appearance of your invoices by hiding columns, changing the column headings and adjusting the display order. More about customising invoices.

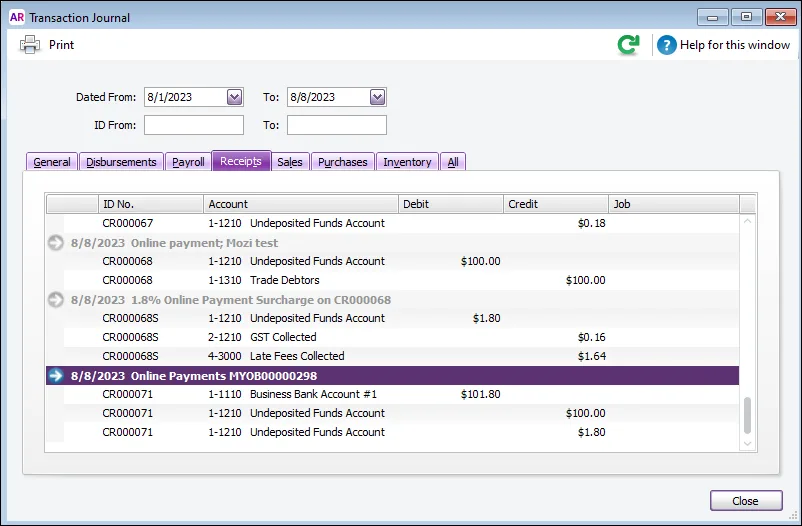

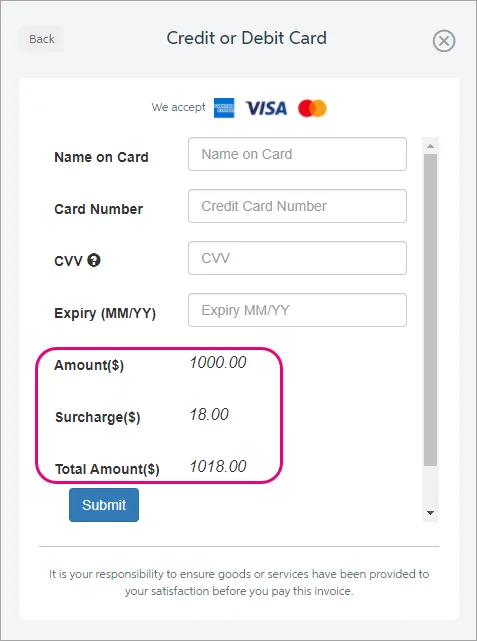

More flexible surcharging with online payments

If you enable surcharging on your online payments, the 25c transaction fee will now also be passed on to your customers in addition to the 1.8% surcharge (excluding BPAY). Also, you can now exclude BPAY as a payment option, making online payments a cost-free option to your business. More about the changes to surcharging.

Banking

Easier to identify bank feeds

We've added a Reference column to the Bank transactions page to show the supplier invoice number or customer invoice number for your bank feed transactions. This makes it easier to identify the MYOB bill or invoice the transaction relates to.Smarter auto-matching

We've improved bank feed automatic matching to use the bank transaction description to match with invoice numbers and customer names more intuitively. There's more improvements to matching coming in future releases – so watch this space.More options for connecting credit cards

When you connect a credit card to MYOB, you can now link it to a liability category in your category list (chart of accounts).

Bug fixes

We fixed an issue that was causing superannuation transactions to appear doubled up on the Find transactions page

Users who are only assigned the Contacts role will no longer see the ‘Something went wrong' error when signing in.

Because of an issue preventing editing of the Tax code column heading is sales templates, we've turned off the ability to edit that column heading.

July

Payroll

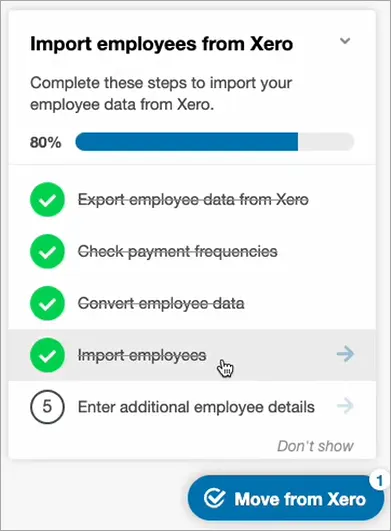

Helping you move from Xero payroll

Within the first 30 days of moving from Xero (Payroll Only) to MYOB Business (Payroll Only), you'll have access to a handy migrator to bring across your employee information. You'll be guided through the process to quickly get your employees set up in MYOB without all the manual data entry. Tell me more

Sales

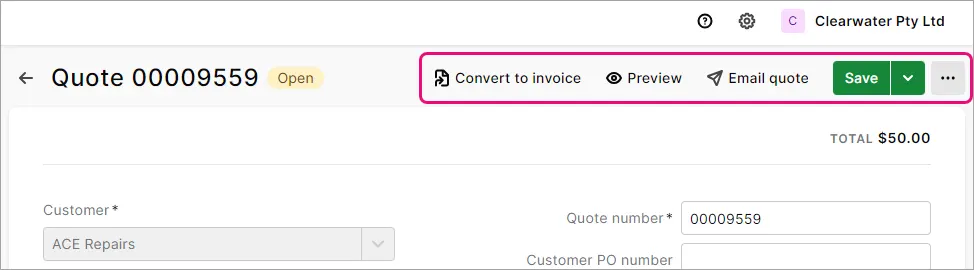

Easier to save and share quotes

We've moved the save and share options in quotes to the top of the screen. This simplified layout helps get your quotes created and sent faster. More about quotes

More sales template customisation options

Personalise your invoices, quotes and statements even more with the ability to add your business's terms and conditions. You can now also upload multiple business logos and header images so you can choose different ones for different templates. More about personalising invoices

Purchases

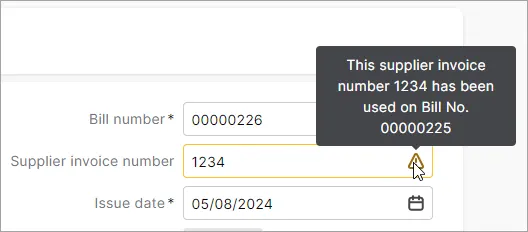

Avoid duplicate bills

If you're creating a bill manually or from an uploaded document, you'll now be warned if the Supplier invoice number has previously been used.

Banking

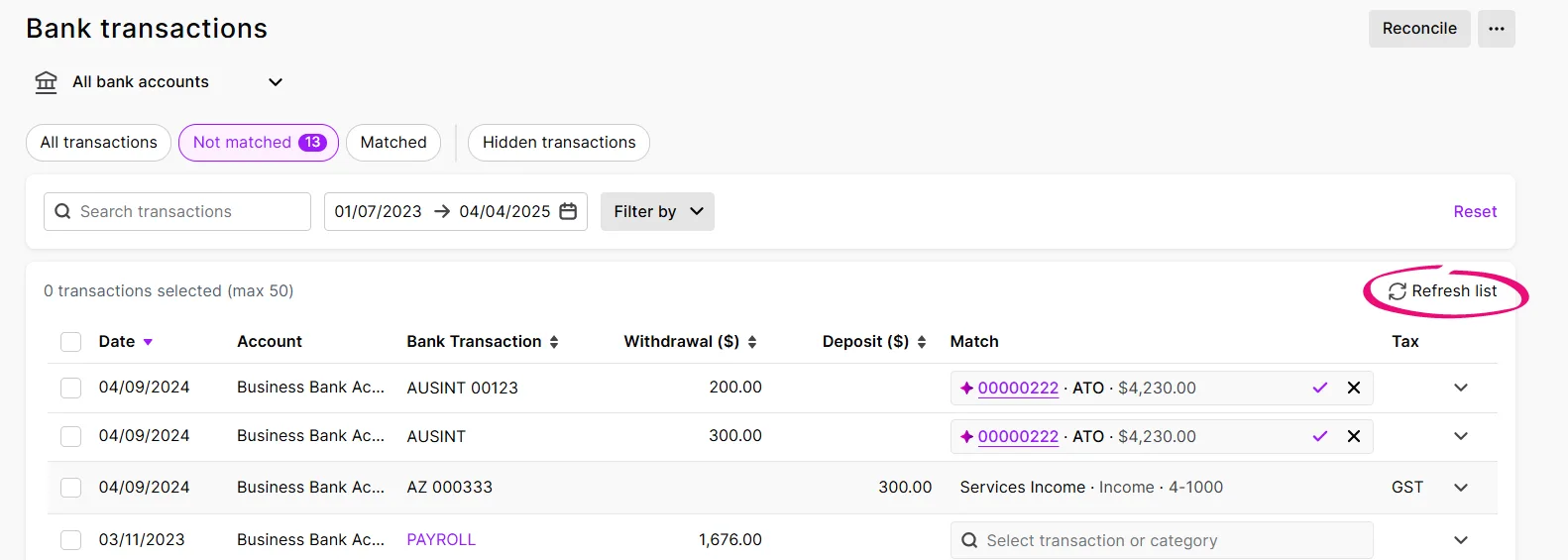

Faster bank transaction categorising

As you're categorising transactions, you can now refresh the Bank transactions page. This reduces the clutter by removing the transactions you've categorised, and leaving the ones you need to focus on.

June

Payroll

Keeping you compliant for the new payroll year

The tax tables have been automatically updated and will apply for pays dated 1 July 2024 onwards. After processing your first July pay, you'll see the new tax table date via the settings (⚙️) menu > Payroll settings.

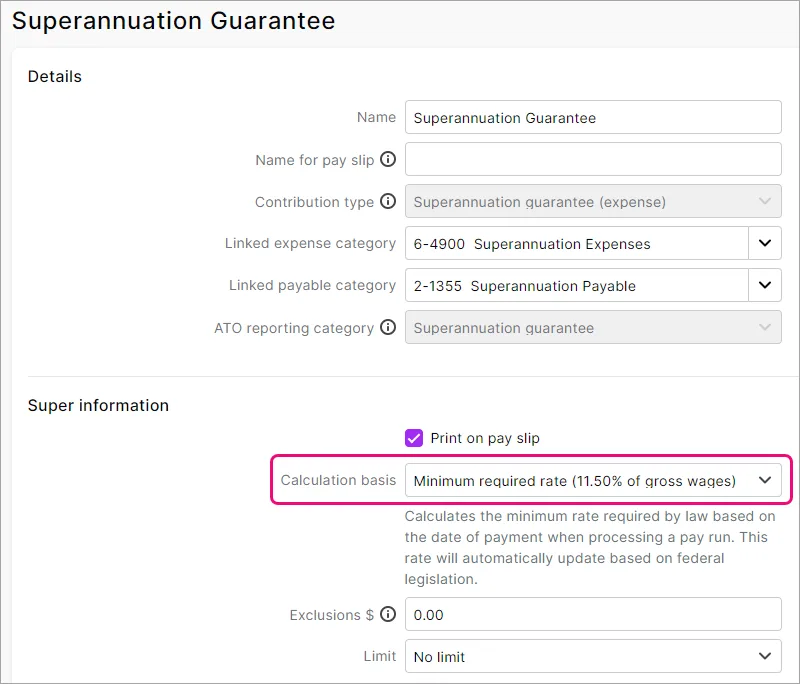

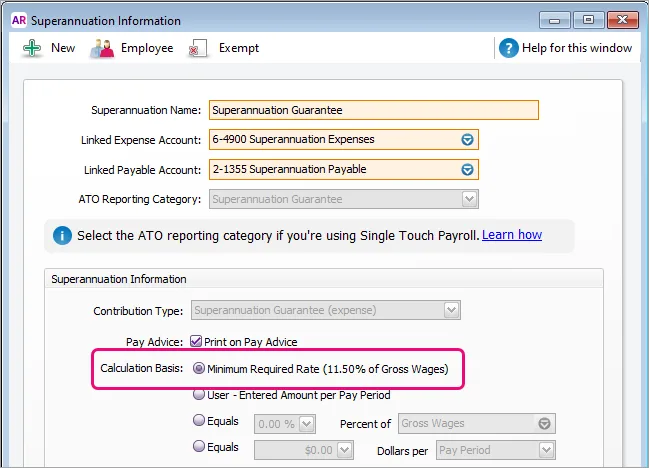

Helping you automate the super rate increase

The super guarantee rate increased to 11.5% on 1 July 2024. Any super guarantee pay items with the calculation basis set to Minimum required rate will be automatically updated to 11.5% when you do your first pay with a payment date on or after 1 July 2024.

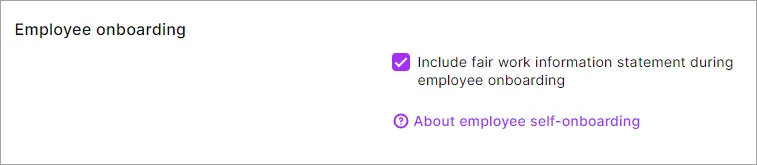

Easier Fair Work compliance

If your business isn't covered by the Fair Work System, you can now choose to prevent new employees being provided the Fair Work Information Statement when you invite them to self-onboard. You'll find this preference via the settings (⚙️) menu > Payroll settings.

Helping you set a default super fund

When you send a request to an employee to enter or check their details and you haven't set a default superannuation fund in MYOB Business, you'll be prompted to do so.

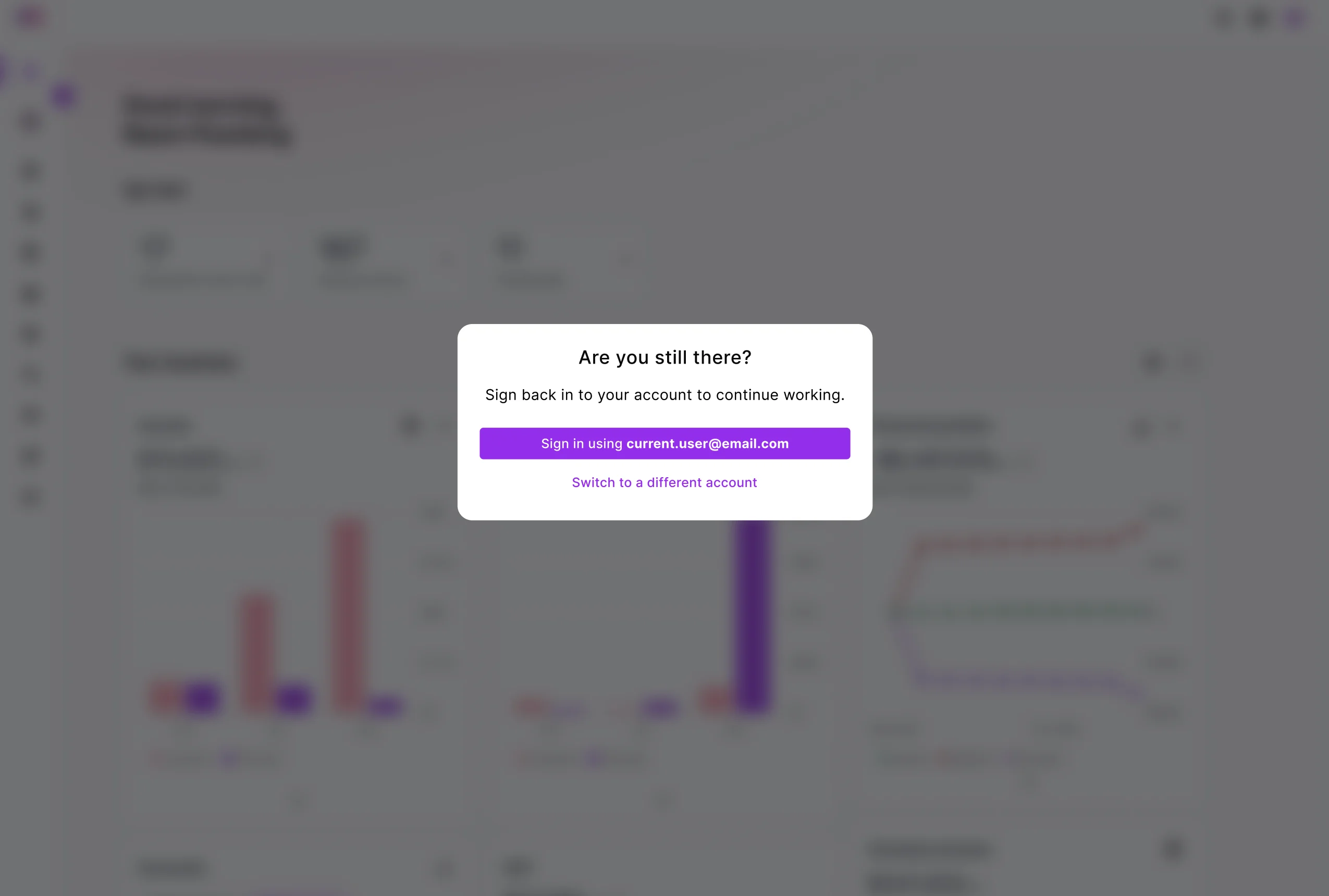

Sales

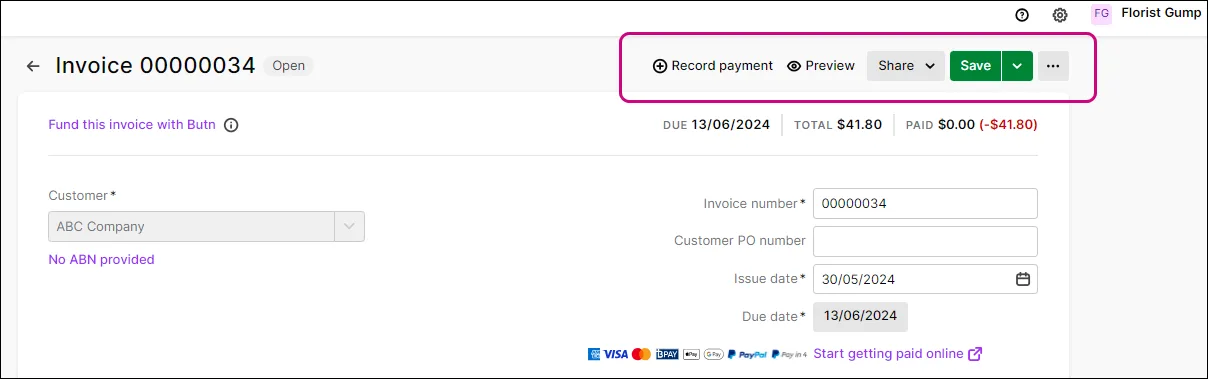

Easier to save and share invoices

We've moved the save and share options in invoices to the top of the screen. This simplified layout helps get your invoices created and sent faster.

May

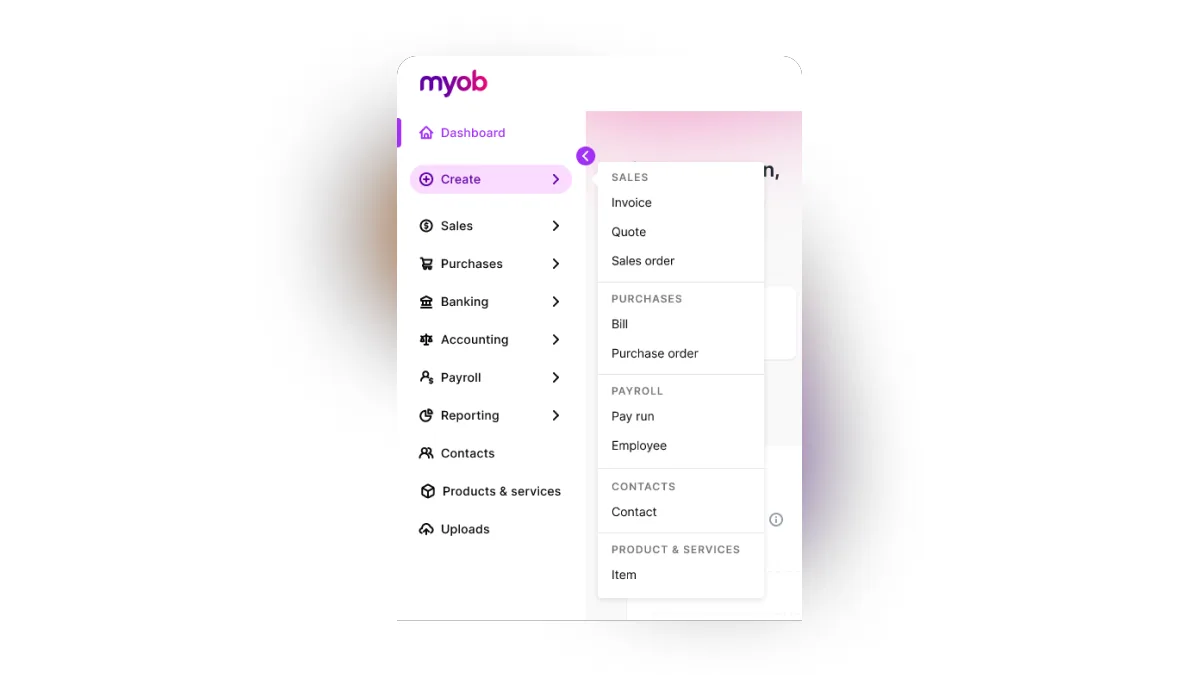

New vertical menu and simplified language

We've moved the menu to the side and used simpler labels to make it easier to find your way around. We've also replaced a lot of technical terms with more familiar words. Discover all the changes.

Two-factor authentication enhancements

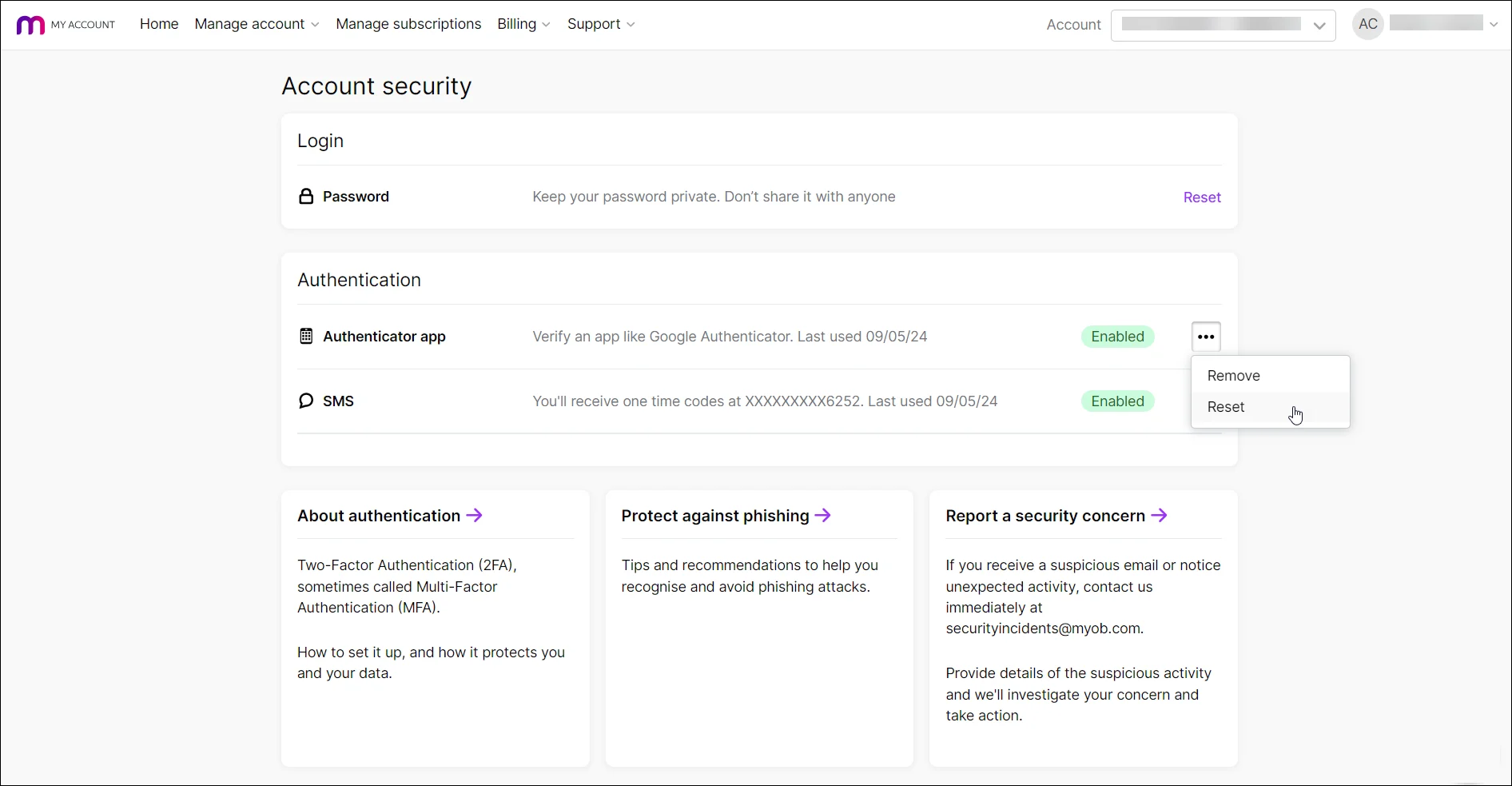

Avoid getting locked out by setting up another 2FA method

Give yourself more options to sign in by setting up more than one 2FA method. For example, you could set up SMS 2FA on your phone and the 2FA authenticator app on a tablet. Then, if you don't have your phone handy and can't receive SMS, you can still get your 2FA code using the authenticator app on the tablet.

Reset 2FA without having to contact MYOB Support

Once you’ve set up another 2FA method, you’re able to change your 2FA settings yourself:

In the Account security section of My Account, you can easily change your 2FA phone number for SMS 2FA, re-link or change your authenticator app, or set up authenticator app on a new phone.

Payroll

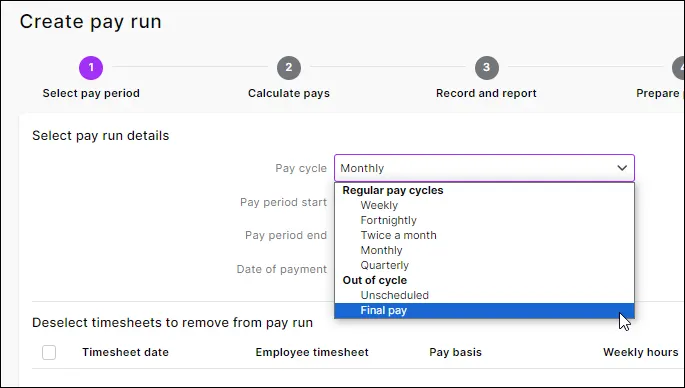

Easier final pays

We're working on a new final pay feature and the first stage is here. There's a new pay cycle called Final pay, and when you choose this you'll be guided through the payment of unused annual leave. Initially this is just for employees who are leaving voluntarily, but we'll add other final payment types, like unused long service leave, in future releases.

Bug fixes

In the Balance sheet report, if you click to view a category's transactions, the report date range is now remembered. Previously the transaction list was being dated from the first day of the current month – which may have resulted in no transactions showing.

In the General ledger report, inventory adjustments now show both the debit and credit amounts against the inventory asset account.

When submitting a request to self-onboard an employee, the Provide access to employee benefits option now only shows if you're not already signed up for employee benefits.

April

Payroll

Helping you stay compliant

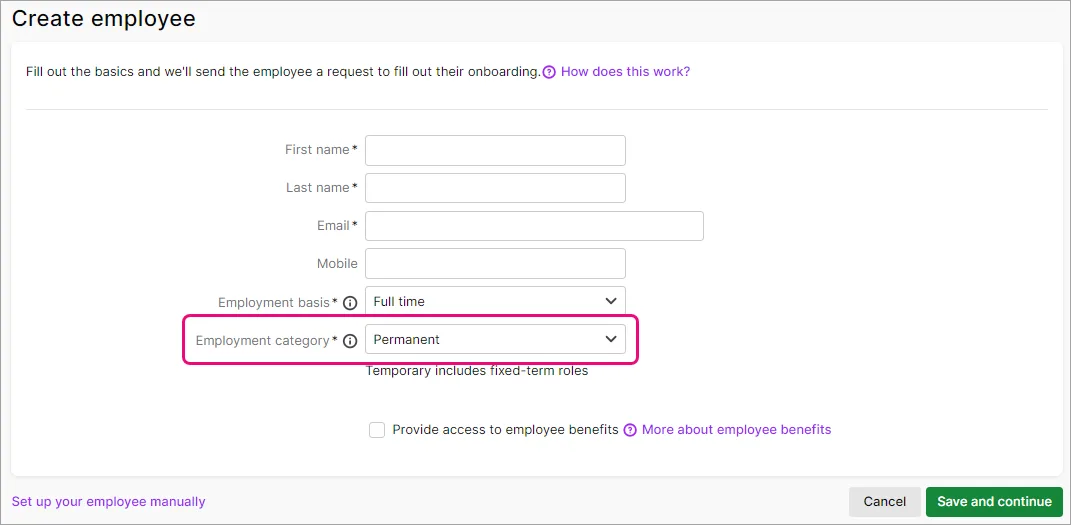

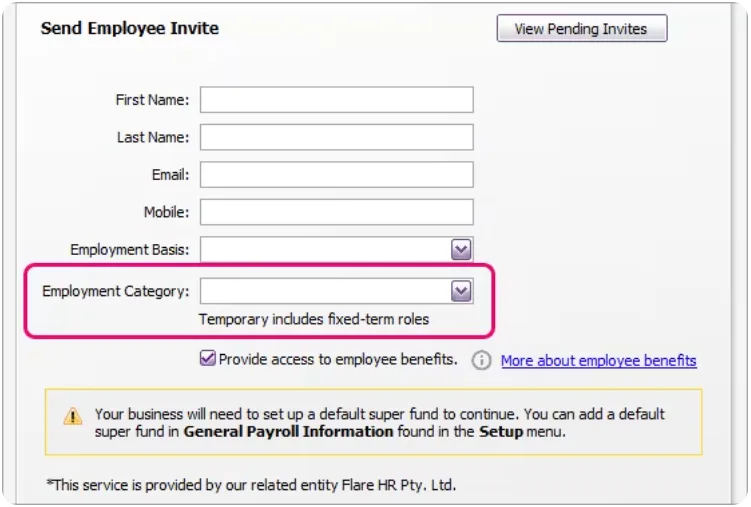

When you add an employee, you'll now choose if they're permanent or temporary (which includes fixed-term roles). This ensures temp employees are provided the correct Fair Work Information Statement when they self-onboard or check their details.

Sales

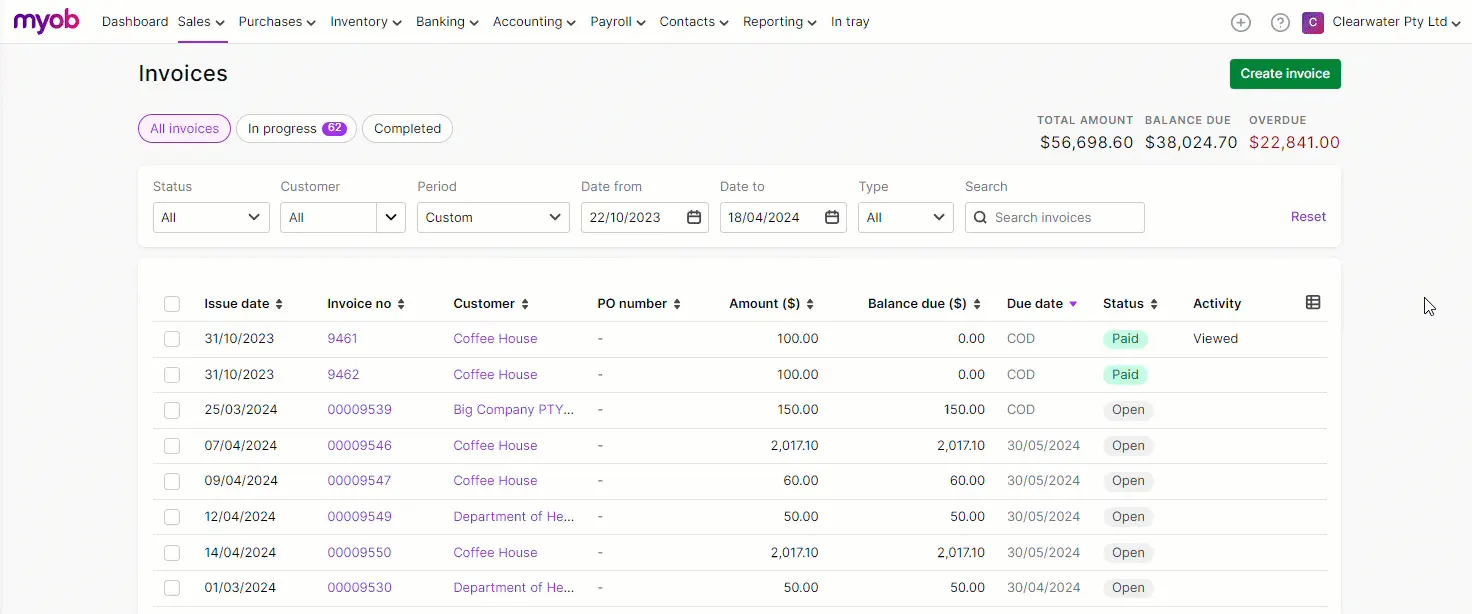

Customise what you see in your invoice and quote lists

Use the new Column options button to show, hide and rearrange columns. Each user can save their own view so it's remembered each time they go to these pages.

Banking

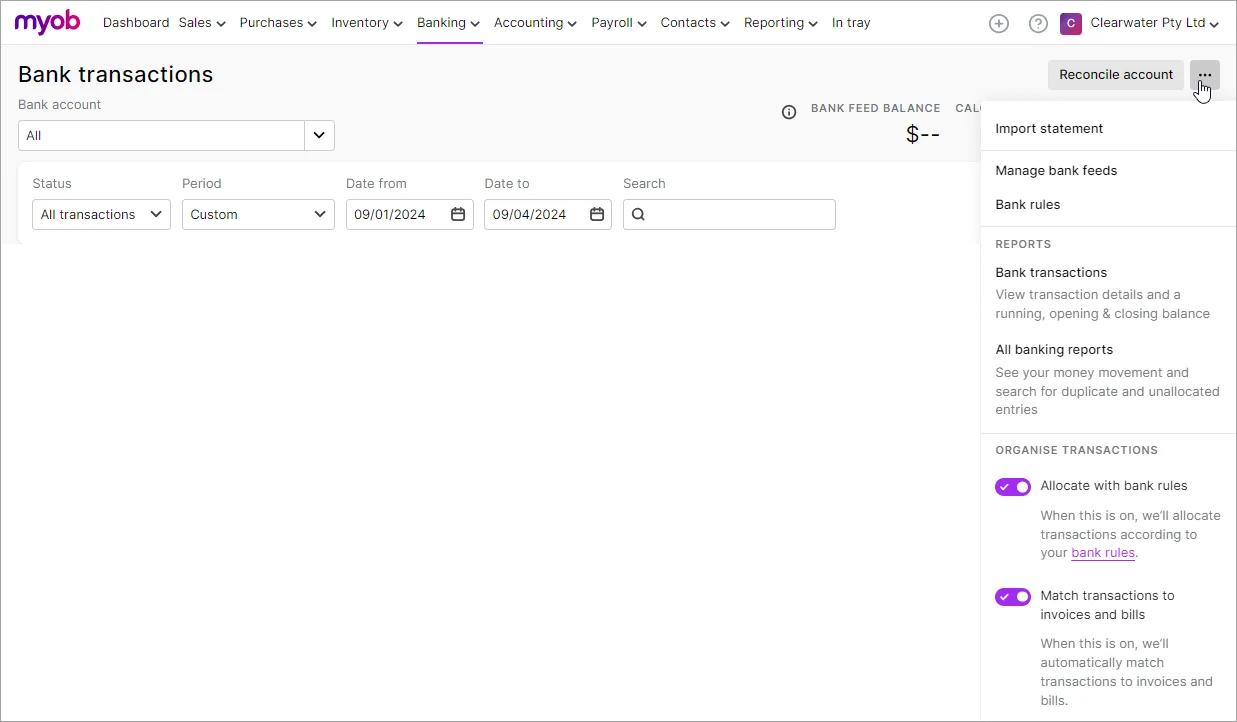

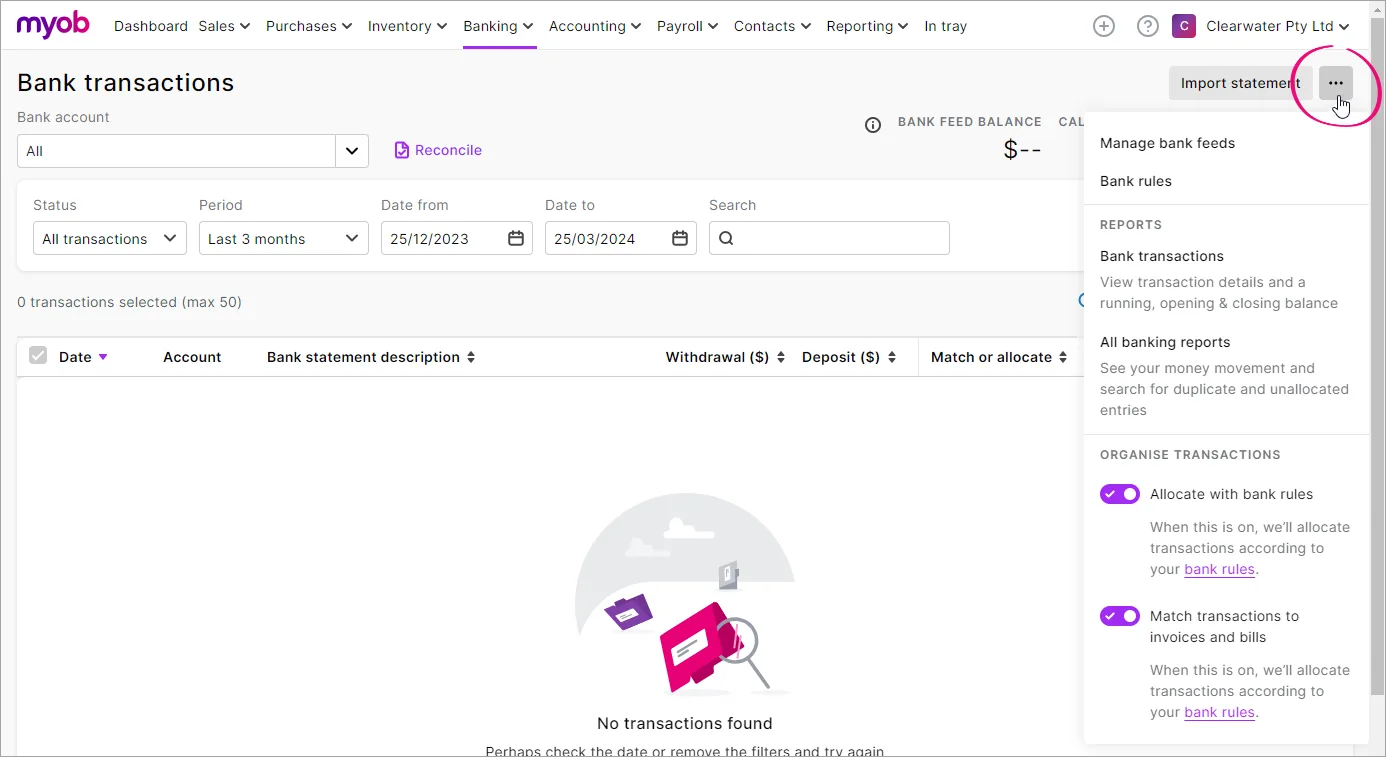

Do more from the Bank transactions page

Many common banking functions, like Import statement and Bank rules, are now available from a quick access menu. Click the ellipsis button (...) to quickly access these tasks from the one place. We've also decluttered the page by moving the Reconcile account button to the top-right corner next to the quick access menu.

March

Payroll

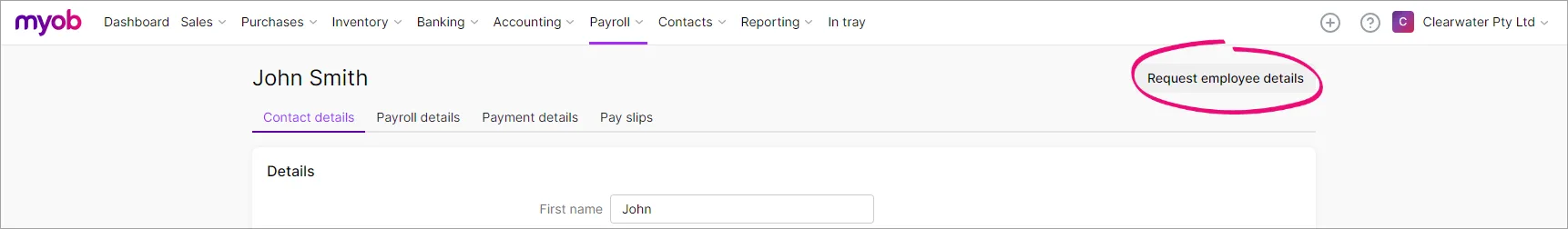

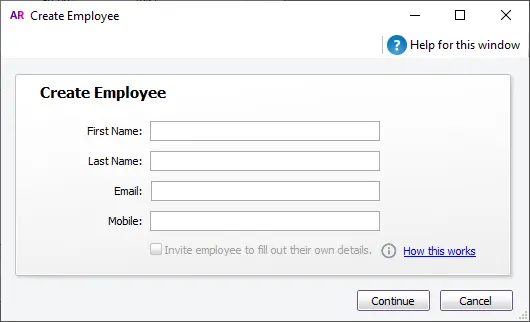

Get new employees to check their details

If you've manually set up an employee, or an employee wants to update some details, you can now send them a secure request to review or update their details. Just click Request employee details in the employee's record. Any updates they make will be sent straight into your MYOB Business file. See how it works

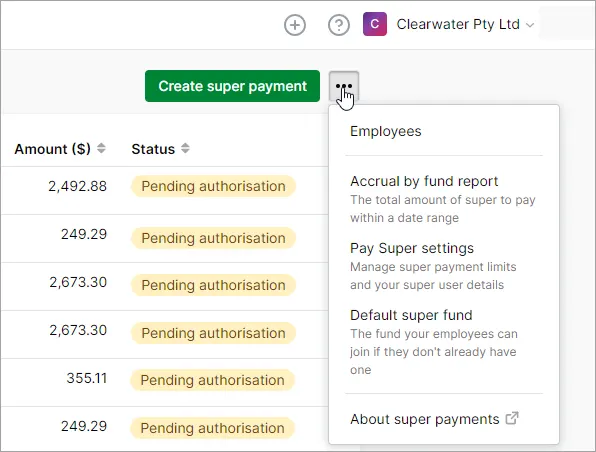

Quicker access to super features

We've added a shortcut menu to the Super payments page for handy access to common things, like your employee list and pay super settings. Look for the ellipsis button (...) next to the Create super payment button.

Sales

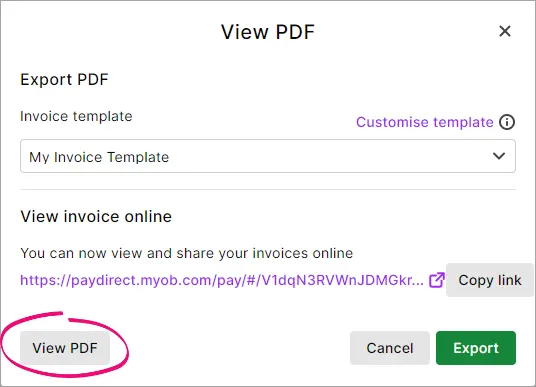

Preview an invoice before downloading it

When you export or download an invoice PDF, you can now click View PDF to see a preview.

Banking

Quick access to banking features

We've added a quick access menu to the Bank transactions page, giving easy access to bank feed rules and reports. Just click the ellipsis button (...).

More flexible BAS report

Save a draft

If you need to stop doing a BAS report, just click Close to save it as a draft and come back to it later. When you reopen the draft you're prompted to review any changes that have been made that affect it.

Refresh the BAS report

If you make any changes to transactions while you've got a BAS report open, just click Refresh to update the report with your changes.

Usability improvements

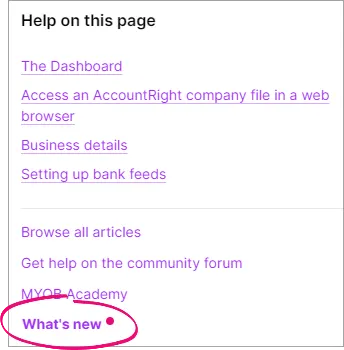

Stay up to date when we release something new

When we've released an update for MYOB Business, you'll now see a red dot next to What's new in the help panel (displayed by clicking the question mark icon in the top-right corner).

February

Bug fixes

We fixed an issue that was causing help links to open on the same browser tab as MYOB Business. Now when you click a help link, it'll open on a new browser tab.

January

Usability improvements

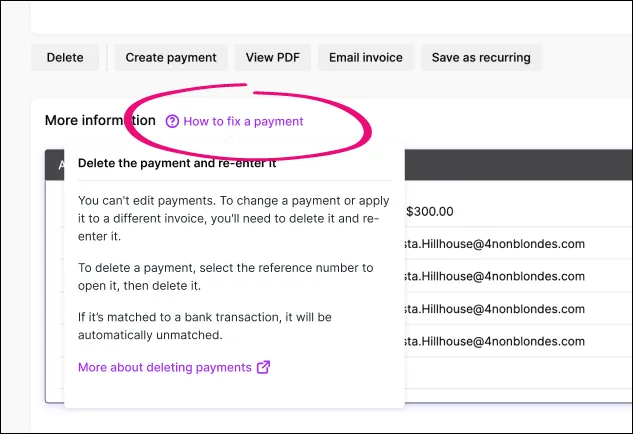

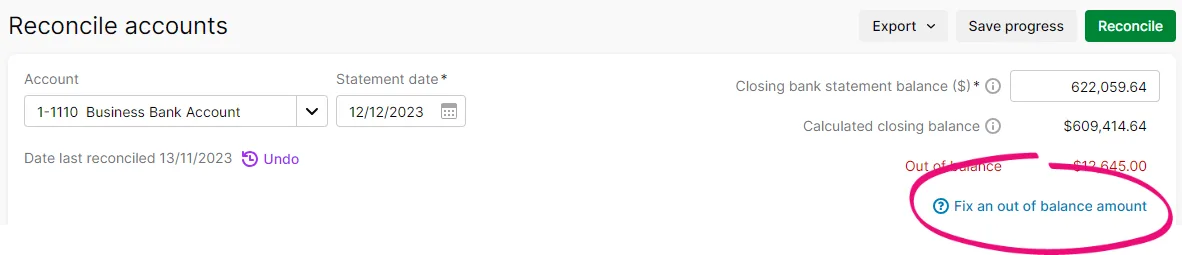

Even more help where and when you need it

We've added more clickable help links where you might need a little extra info, like fixing a pay or an out of balance reconciliation. Look for the blue links with question marks.

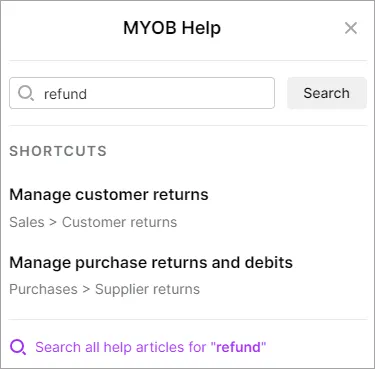

Smarter searches

When you click the help icon and start typing a search, we’ve improved the list of keywords that are used to present matches to information or features that you're looking for. You can now open the search results in a new tab or window, which leaves your original search results available.

Clearer BAS processes

When you prepare your BAS, you'll see we've renamed Finalise to Save at the end. There's now also a clear message that reminds you to lodge the BAS. Also, during the BAS process you'll now see links to view or edit transactions so you can easily check or change things when preparing the reports.

Reports

New bank activity report

We've added the Bank activity report so you can see all transactions that have been allocated to bank or credit card accounts. All transactions are shown in the report regardless of how they've been entered. This is compared to the Bank transaction report, which only shows bank transactions entered via bank feeds or imported bank statements. This is handy if you haven't been using feeds or importing bank statements.

Spend less time filtering reports

We've improved filtering in reports so that the filters you choose are remembered in each report. The filters in one report won't affect the filters in another.

When you open the following reports for the first time, the filters are now set to the most commonly used settings, but you can change them if you like, and they'll be remembered:

Account list

Bank transaction report

Coding report

Bank reconciliation report

Statement of cash flow

Cash movement

Category general ledger

Sales

Attach files to sales

You can now attach PDF, TIFF, JPEG or PNG files to the Attachment section of invoices, sales orders, or quotes. Attached files are included if you email the sale.

Bug fixes

We fixed an issue on the Reconcile accounts page that was causing the amounts to be misaligned under Withdrawal and Deposit.

The running balance on the Bank transactions report now matches the last bank feed balance provided by your bank.

2023

December

Usability improvements

Quickly get to the tasks you need

When you open the help side panel, the search box now lets you go to the place in MYOB Business you're looking for. For example, if you're not sure where to record a customer refund, just type 'refund' in the search box.

If you want to search the help, there's also a link at the bottom of the results.

More help where and when you need it

We've added clickable help links in places where you might need more information, such as fixing a pay or an out of balance reconciliation. Look for the blue links with question marks.

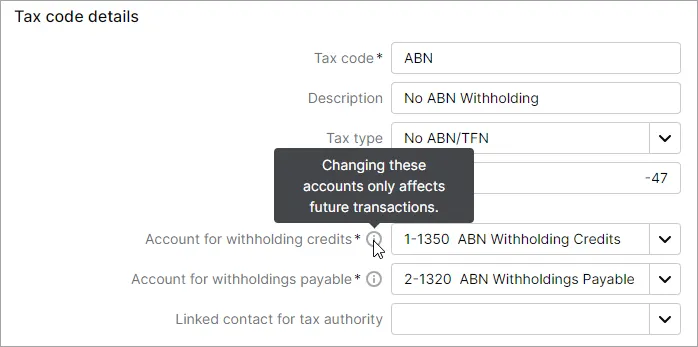

Better guidance when editing the ABN tax code

We've added some text to explain the implications of changing Account for Withholding credits and Account for Withholding Payables for the ABN tax code.

Reports

Retain preferred filters on the Coding and Accounts list reports

When you change the filters on the Coding and Accounts list reports, they're now remembered for next time and not impacted by other report filters.

November

Payroll

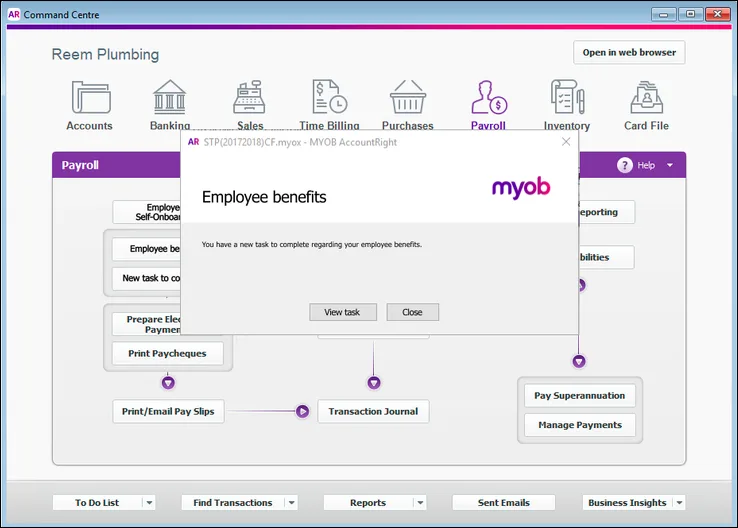

More ways to engage and reward employees

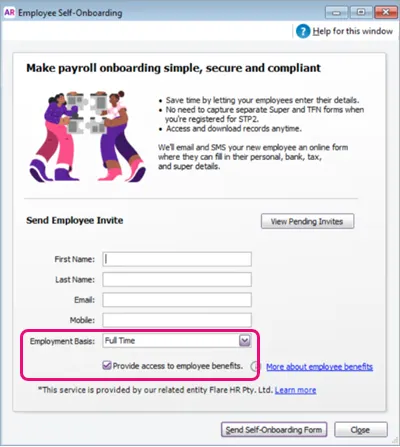

When inviting an employee to self-onboard, you can give them access to employee benefits. You won't see this option if you've already set up employee benefits.

Helping you stay Fair Work compliant

When you set up a new employee, you'll now choose their Employment basis. This ensures that they're provided the correct Fair Work Information Statement when they self-onboard.

Invoicing

Print multiple invoices from one place

The new Print PDF button on the Invoices page lets you print multiple invoices at once. Not available in AccountRight browser

Quickly show all invoices

When viewing the Invoices page, you can now choose All time as the Period to show all invoices without having to set a date range.

Helping you avoid duplicate invoice numbers

When you create an invoice with an invoice number that's already been used, you'll now see a warning.

Dashboard

Choose whether amounts include GST

There's now a Dashboard option to show whether amounts are GST inclusive or exclusive in the Income, Expense and Financial position widgets.

Expanded insights for cash in and out

You can now choose to see the Last 6 months for the Income and Expenses widgets.

Usability improvements

You can now see what's new without leaving MYOB Business

Click the help icon and look for the What's new link at the bottom of the help panel.

Reports

Making sure GST calculates correctly in the Budget management report

If you run the Budget management report (Cash movement type) with Auto-calculate GST selected you'll be warned if the GST Clearing Account is inactive or has been deleted. You'll also see the steps on how to fix it.

Banking

Quicker access to the Bank reconciliation report

When you reconcile an account, you're now prompted to export the Bank reconciliation report from the Bank reconciliation page. Previously, you had to manually run the report and set the filters for the account you just reconciled.

Bug fixes

The GST Return summary now correctly omits the cents rather than rounding up or down to the nearest dollar. This is in line with ATO requirements.

The correct accounting method is now shown when viewing, printing or exporting the GST return report.

October

Dashboard

The new Dashboard is back

The revamped version of the MYOB Business Dashboard is being re-introduced, after being improved to address performance. See what's new.

Bug fixes

The Bank transactions report now only shows transactions from bank feeds or imported bank statements. Previously, it was also showing manually entered transactions.

We fixed an issue that was preventing dragging and dropping attachments into a transaction in the Bank transactions page.

September

Payroll

Easier access to an employee's pay slips

You'll now find each employee's pay slips on the new Pay slips tab in their employee record. This makes it easier to find, view, print or email their pay slips – all from one place.

Reports

View and print with one click

We've added a View and print button to reports to generate a PDF with a single click.

More meaningful PDF file names

Reports exported as PDFs now have a more meaningful name that include your business name and the report name, like My business Pty Ltd - ProfitAndLossReport.pdf

Choose your PAYG Withholding reporting frequency

If you use payroll and you're registered for GST, you can now choose your PAYG Withholding reporting frequency (Monthly or Quarterly) in the report settings. This is useful if you report GST and PAYG Withholding at different frequencies.

Usability improvements

We've made some design improvements on the Bank transactions page to make it easier to identify unallocated transactions.

Bug fixes

The column headings and amounts in the Payroll summary report now line up correctly when exported to PDF.

We fixed an issue that caused the same error to show multiple times when running a customised Balance sheet report outside the current financial year.

Performance improvements

We've improved how information is stored and handled in the pay run, making it quicker to do your payroll.

August

Activity statements

More control over your Activity Statement reporting

You can now accept or decline the suggested prior period adjustments when preparing in your BAS report.

Payroll

Easier to find an employee in a list

Employees are now sorted by their first names wherever they're listed, such as in a pay run and the Employees page. Previously they were sorted by their last names.

Bank transactions

Simplified matching of money transfers

When you create a transfer money transaction on the Bank transactions page, it will be automatically matched without needing to refresh the page.

More help at your fingertips

You can now click a link on the Rule type field when setting up a bank rule to display help content explaining the difference between an automated rule and an allocation template.

Keeping you informed about bank feed issues

If there's an issue affecting bank feeds, like a delay in receiving transactions, you'll now see a notification on the Bank transactions page detailing the issue. The notification is updated when the issue is resolved.

Reports

Easier to review trends across financial years in the Balance sheet report

You can now break down the Balance sheet report across financial years to compare data and show trends. Previously, you could only break down the report for one financial year.

Get a clearer break down of leave in the Payroll register and Payroll activity reports

The Payroll register and Payroll activity reports now display leave accrued and taken. Previously, these reports only had one Leave column and it wasn't clear to users what value it represented.

Bug fixes

When you sort the Users page, Remove access and Cancel/Resend invitation now works on the correct user.

You can no longer match or allocate transactions for a new bank feed until you've linked the bank feed to an MYOB Business account.

The Reconcile link on the Bank transactions page now displays correctly when you resize the page.

We've aligned columns in the GST report and General ledger report so that amounts line up with column headings.

Reports that are exported to excel or PDF now correctly show negative numbers in brackets if this option has been selected.

Performance improvements

We have removed an exception alert message that briefly appeared from the top of some reports, like the Balance sheet, Profit and loss and Unpaid bills reports. This will improve the loading time of these reports.

June

Online Invoice Payments

More payment options for your customers

Your customers can now pay your online invoices using PayPal or PayPal Pay in 4, which now appear as payment options in online invoices.

Sales orders

You can now email sales orders

Get your sales orders out faster by emailing them when you create them, or later. Just as with invoices, you can add attachments or email to multiple addresses.

Activity Statements

Complete your BAS faster with fewer errors

You're now stepped through completing your BAS report and you'll see transactions that were added, edited or deleted in the previous reporting period. These are now displayed in the new Prior period adjustments report, to help balance your end-of-year GST reconciliation.

Payroll

Keeping you compliant for the new payroll year

The tax tables have been automatically updated and will apply for pays dated 1 July 2023 onwards.

Helping you automate the super rate increase

Any super guarantee pay items with the calculation basis set to Minimum required rate will automatically update the super rate to 11% when you do your first pay run with a payment date on or after 1 July 2023.

Add a logo to brand your pay slips

If you have a business logo, you can upload it into MYOB so it appears on your employees' pay slips. Just click your business name and go to Business settings > Brand settings tab to upload your logo.

Clearer pay slips for casual employees

Annual salary no longer appears on pay slips for casual employees.

EOFY finalisation has been updated for STP Phase 2

Employee Gross YTD ($) values in the STP reporting centre now include all STP Phase 2 wage reporting categories (like Overtime and Bonuses). Previously for STP Phase 1, Gross YTD ($) only included wage pay items assigned the Gross Payments reporting category.

Usability improvements

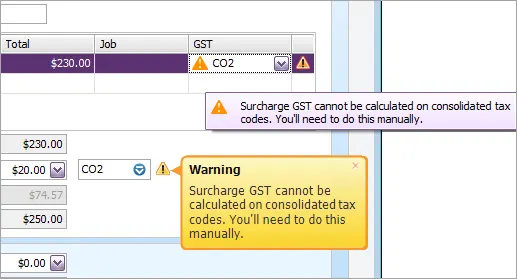

You'll now see a message that customised and consolidated tax codes are not included when preparing the reports for your activity statement.

Clicking Overdue invoices in the Up next section on your Dashboard opens the Invoices page, which will now show just your overdue invoices.

Easily identify credit notes on the Invoices page with the new credit note icon in the Amount column.

When scrolling down the Bank transactions page, the column headings now remain visible, making it easier to identify the columns.

We've made the Possible match found text on the Bank transactions page more visible by changing the text to purple.

Bug fixes

The Trial balance report now shows the YTD column instead of the As at date when comparing periods.

We've temporarily removed the Superannuation and PAYE withholdings payable Dashboard widgets while we investigate why they were affecting performance.

Fixed an issue that was preventing report packs working if they included a Payroll summary or Payroll activity report.

Clicking Possible match found on the Bank transactions page now shows the Match transaction tab with a list of possible matches (instead of the Allocate tab).

Unnecessary horizontal scroll bar no longer appears when you expand a transaction on the Bank transactions page.

When you expand a transaction on the Bank transactions page the headings and contents of each column now align.

Performance improvements

To make the Dashboard load faster, Income and Expenses data for the last 6 months no longer appears.

May

Sales

See the activity of your sales orders

At the bottom of a sales order, you'll now see a More information section, showing the activity on a sales order, like when it was created and converted to an invoice.

Reports

Trial balance report now shows Year to Date (YTD) balances when comparing periods. When comparing periods, YTD debits and credits are combined into a single column.

Bug fixes

When you edit text in the Bank statement description field on the Bank transactions page, the edited description now changes to purple indicating that it's been changed. When you hover over the edited description, you can see the original text.

You'll no longer see an error message when editing header accounts.

Transaction reference numbers that are 13 characters long are no longer truncated when matching on the Bank transactions page.

Created from sales order no longer appears twice in invoice Activity history when you record a payment against a sales order in AccountRight desktop and then convert the sales order to an invoice in AccountRight browser. (AccountRight Browser)

When paying multiple Lump Sum E payments in a pay run, the $1200 threshold is now applied to the consolidated amount. Previously the threshold was being applied to each Lump Sum E payment.

April

Usability improvements

A refreshed look and feel

We’re rolling out a refreshed user interface that gives you a modernised user experience. It includes a new typeface and updated colour palette to improve accessibility with increased contrast and legibility, making it easier to complete your tasks.

More meaningful PDF filenames

Downloaded invoices, bills and quotes now have more meaningful names that include the reference number, like Invoice-00000328.pdf

Sales

Save time by setting a customer's default payment terms

When you set a customer's payment terms on an invoice, there's an option to Remember terms for this customer. This means you don't have to manually set the terms each time you create a customer's invoices.

Know straight away when you've emailed an invoice

When you email an invoice, the Activity column on the Invoices page now shows Sending immediately so you won't accidentally email the invoice again. Previously you had to refresh the page to update the status.

Clearer field descriptions

We've added a clear description of the Unit field in invoices and quotes. We've also made the description of the payment terms setting clearer in the sales settings.

Know if you're missing required unit details

You'll now see a warning message if the No of units or Unit price fields are blank but are needed to save the invoice.

Clearer invoices statuses

Unpaid invoices past their due date now show an Overdue status, and you can filter the Invoices page to show only overdue invoices.

Bills

Better management of bill attachments

Use the new Attachments panel to keep track of all the documents related to a bill. Upload multiple files straight into a bill, see what's attached, and download or delete existing attachments.

Reports

See unallocated bank transactions in the Bank transactions report

There's now an option to view unallocated transactions in the Bank transactions report. If you select this option, when you expand an account you'll now see unallocated transactions for that account. This means the true running balance of bank accounts is now displayed and can be compared to bank statements at any specific date.

eInvoices

You can now receive eInvoices with multiple attachments.

Bug fixes

When adding a new account via the Account dropdown list in the Create recurring transaction page for a general journal, the account now appears without needing to refresh the page.

Fixed an issue that was preventing the mapping of tax codes when exporting data in Sage Handiledger or Reckon APS formats.

Invoices with a balance of $0.49 or lower no longer show a status of Closed on the Invoices page.

When converting a quote to invoice, the invoice issue date is now set as today’s date instead of the quote's issue date.

Resizing the Notes to customer fields now works as expected.

Fixed a bug that could cause a "Something went wrong" error when trying to open the Invoices page.

You'll no longer see the Save invoice? prompt if you've made invalid changes to a closed invoice.

PDF invoices now correctly use the Feature colour you've set in the invoice template if the option Full width header image is selected for that template.

You can now successfully save a recurring invoice when there are more than 3 decimals in the unit price and there is more than one unit.

The invoice status now shows as expected on an invoice when the Due date is set to Prepaid or Cash on delivery.

March

Online Invoice Payments

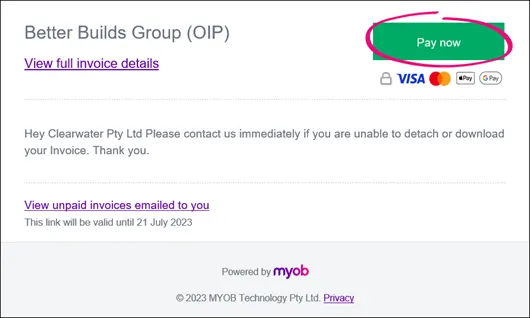

Send invoices by SMS

When you email an invoice set up for Online Invoice Payments, there's now an option to also send an SMS with a link to the online invoice. Make sure your customers see your invoices and prevent them getting lost in a busy inbox.

The Dashboard

Clearer and more helpful information

We’re rolling out a completely revised and improved Dashboard. In the new Bank accounts section, you’ll see the last-synced bank feed date and unallocated transactions for each account. Cash received and spent is included in the new Income and Expenses sections. And if you’ve upgraded from MYOB Essentials, we’ve brought back some favourites.

Eventually, all MYOB Business and AccountRight browser users will have these and many other enhancements – find out about the new Dashboard.

Sales

Create sales orders to put items and services on order

Use sales orders to create a centralised record of your customer orders that you can pull up at any time, anywhere. When you enter a sales order for an inventoried item, it's marked as committed to customers, helping your purchasing department make informed inventory ordering decisions. You can use sales orders for both goods-based and service-based businesses. Learn more.

Bug fixes

Your chosen GST clearing account now appears on the Cash movement and Budget management reports.

Spend money attachments now show the correct file size.

When you add a new account while you're creating a recurring general journal entry, the new account now appears in the Account field.

February

Payroll

Temporarily assign a pay item during the pay run

When you do a pay run you can add any existing pay item to an employee's pay. The pay item will only apply for this pay.

Check employee leave balances during the pay run

During a pay run you can see current and projected leave balances by hovering over the information icon for any leave wage pay item.

See the hourly rate for wage pay items during the pay run

When you view an employee's pay details during the pay run, you'll see the hourly rate for each wage pay item in the Rate column.

Handling pay rate changes in saved pay runs

If a pay rate has changed since you saved a pay run, you'll see an alert icon against the affected pay item. Click the icon and then click Update to use the new rate, otherwise the original rate will be used.

Bank feeds

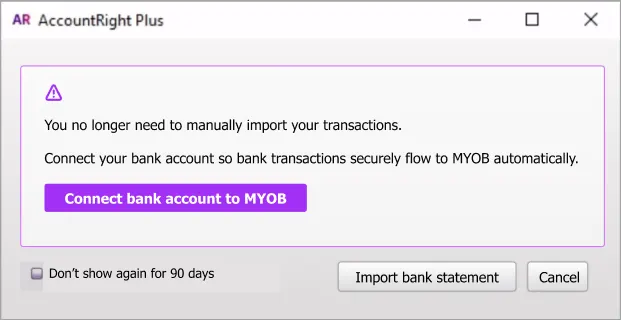

Clearer information and guidance when setting up bank feeds

There's more information during the bank feed signup process. When your bank feed is connected, you'll see a notification on your Dashboard telling you to link it to an MYOB account.

Dashboard

Refreshed the look of the getting started tasks you'll follow when setting up a new MYOB Business file.

Bug fixes

Pay run error messages are now displayed correctly.

We fixed an issue that caused some bank feed rules to result in an out-of-balance bank reconciliation.

Bank account number no longer appears blank in the Chart of accounts when setting up electronic payments.

We fixed an issue that was preventing some employees from being added to the MYOB Team admin portal.

Refund amounts applied to bills now display correctly in the Job profit and loss comparison report.

January

Bug fixes

Report PDF style templates with the page layout set to Landscape and Compact now display 12 columns correctly.

The Job profit and loss comparison report now only shows transactions related to the specified jobs.

You can now click the cost of sales account in the Profit and loss report to see the related transactions.

The reports in the default Management Report report pack now use the accounting method based on your report settings.

2022

December

Payroll

Easier leave setup

New MYOB Business files now come with default leave pay items for salaried and hourly-based employees. This ensures leave accrues and is paid out correctly for full time and part time employees. Learn more...

Bug fixes

The Balance sheet report now prevents you from using the Breakdown option when in Cash mode, preventing incorrect display of breakdown amounts.

You now receive a confirmation email when an item import has failed.

Trial users are no longer presented with a payroll onboarding task if they've indicated they have no employees.

The Cash movement report no longer displays an error when using the Compare to budget option.

You can now successfully open a copied budget if the Auto calculate bank accounts option has been selected.

November

Payroll

Improved error messages across a range of payroll workflows, including when:

entering employee payroll information such as pay slip email address and hours in a pay cycle

choosing the pay cycle in a pay run and no employees match that pay cycle

setting up and deleting pay items.

More help for rejected STP submissions

If an STP submission has the error CMN.ATO.GEN.XML03 due to missing or invalid information, you'll now see details of the field that's causing the issue and be directed to information to help you fix it.

Better guidance when paying super

We've improved the error message that shows while processing super payments if a selected super fund is no longer accepting contributions.

Reports

Clearer options in the Include items filter in the Stock on hand and Item list reports to better indicate what will be shown in the report.

You can now click into inventory adjustment transactions in the Balance sheet report to see details of the adjustment

Bug fixes

The Bank transactions page now allows account numbers to be found if they contain slashes (/).

The GST return and GST report in a report pack now shows the correct accounting method for cash/payments mode.

The General ledger report now shows correct amounts after applying multiple matching payment amounts to invoices and bills.

Users can now only access reports matching their permission level. (AccountRight Browser)

The General ledger report now shows the correct tax codes for invoices or bills containing items that have different tax codes.

The Balance sheet report now shows the correct Variance % when comparing values to last year.

The Balance sheet report now prevents you from using the Breakdown option when in Cash mode, preventing incorrect display of breakdown amounts.

You now receive a confirmation email when an item import has failed.

Trial users are no longer presented with a payroll onboarding task if they've indicated they have no employees.

October

Payroll

Save your progress when moving to STP Phase 2

If you get interrupted or need to check some details, you can keep what you've already entered so you don't have to start from scratch when you come back.

Find out how to fix rejected pays

If a pay is rejected by the ATO, you'll see clearer info i n the STP reporting centre that tells you how to fix it.

Pay slip email addresses are filled in automatically

When entering a new employee, the email address you enter on their Contact details tab is automatically added as their pay slip email address on the Payroll details tab.

Clearer message when resuming a pay run after changing employee pay items

If you've saved a pay run then change the pay items for an included employee, you'll now see an error message explaining that you can't resume the pay run but will need to create a new pay run instead.

More guidance when paying employees aged under 18

If a pay run includes an employee aged under 18, regardless of pay frequency you'll be reminded to confirm their hours worked, helping you stay on top of your super obligations.

Improved super calculations

Super guarantee amounts are now calculated only on the current pay cycle. If a threshold is set in a super expense pay item category (not super guarantee) the super calculation only includes previous pay periods if the threshold is exceeded.

Easier to expand an employee's pay during a pay run

You can now click anywhere in the row to view or change the details of that employee's pay. Previously you could only click the dropdown arrow to do this.

Extra information about sending an update event

We've improved the description of the Send update event button to make it clearer that using it will create a zero dollar pay run to update the ATO with your employees' latest year-to-date figures.

More help for rejected STP submissions

If a pay run is rejected by the ATO for errors SBR.GEN.AUTH.006, SBR.GEN.AUTH.008 or CMN.ATO.PAYEVNT.EM99507, you'll see details of the rejection and be directed to information to help you fix it.

Ensuring an employee's default pay item matches their pay basis

You can now only remove an employee from the Base Hourly or Base Salary pay item if the employee's pay basis (hourly or salary) is different to the pay item's pay basis. For example, you can't remove an hourly paid employee from the Base Hourly pay item.

Inventory

Include all your inventory items in reports

You now have the option to show items with a zero quantity or value in your inventory reports. This gives you a more complete view of your inventory.

An item name is no longer mandatory when creating an item.

The current value of inventoried items is now shown in your items list.

Inventory - account info message has been updated on invoice screen. Account info message has been updated on invoice screen for creating and updating invoices.

Reports

Clearer report names and descriptions

The Receivables with tax and Payables with tax reports are now called the Receivables reconciliation with tax and Payables reconciliation with tax reports. We've also improved the descriptions of these reports, along with the descriptions for the Unpaid invoices and Unpaid bills reports.

Banking

Transactions from the previous financial year will now be included when you import a bank statement.

Bug fixes

If you're missing a linked account and trying to create an invoice or bill, you'll now see a clear message guiding you to set the linked account.

When creating a purchase order via the reorder report, the item name now appears as expected in the Description field of the purchase order.

Fixed an issue in the Banking reconciliation report that was incorrectly assigning cheques and deposits, causing the Expected balance on statement to be calculated incorrectly.

A user with the Purchases role can no longer access the prepare electronic payments feature. This removes the possibility of a user without payroll access seeing employee pay amounts.

Fixed an issue that was causing exports for accountants to include transactions for the day after the specified date range.

Fixed an issue that could cause an error when processing future-dated pays.

If you've processed a super payment including a negative value, for example after reversing a pay, you'll no longer see duplicated amounts in the General ledger report.

Improved the error message shown if you try to delete an inventory item which has stock on hand.

September

Payroll

STP 2 is back and better

In July we paused transitions to STP Phase 2 to improve the in-product experience. But the wait is over – you can now make the move to STP Phase 2. Find out how...

Better guidance when completing the move to STP Phase 2

It's now clearer that you need to send your latest payroll info to the ATO in order to finish the move to STP Phase 2.

Improved STP reporting centre for mobile devices

The STP reporting centre now displays better on a range of mobile device screen sizes.

Quickly solve "Cessation Reason Code" errors in STP reports

We've made it clearer how to fix STP reports with a status of Accepted with errors if a terminated employee's termination reason is missing.

Employee ordering in the YTD verification report now matches the order in pay runs

Employees are now sorted alphabetically by last name, making it easier to compare the report with your pay transactions and other reports.

Making sure your ETPs are reported correctly

If you need to undo a pay that contains an employment termination payment (ETP), you'll now only be able to reverse it instead of delete it. This makes sure the reversal is reported properly to the ATO.

Smoother switch to STP Phase 2 for "Other" type employees

Employees whose Employment basis is set to Other aren't included in your STP reporting, so the details of these are employees are no longer checked during the move to STP Phase 2.

Bank feeds

Easily tell when your bank hasn't sent an account balance

When your bank doesn't send an account balance with your bank feed, the Bank feed balance now shows $-- instead of $0.

Sales

Save time when entering invoices

You can now choose a default Notes to customer when entering an invoice.

Easier note management

Save changes to a Notes to customer when entering an invoice.

Reports

Easier to read exported reports

When you export a report to Excel or PDF, unexpanded rows are no longer bolded. Only the totals are bolded making them easier to read.

Quickly see if there are customised GST codes in your GST return report

You'll be warned that these GST codes won't be included in the report.

Bug fixes

Transactions dated earlier than the opening balance date in your business settings no longer show in reports, regardless of the date range filters.

Bank rules with multiple conditions no longer display display a separate rules on the Bank rules page.

The full rate of a Tax code is now displayed on the Tax codes page. Previously the decimal places were hidden.

If your MYOB business is not set up for GST, you'll no longer see the tax options when setting up a general journal recurring transaction.

Bill payments with discounts or that were applied from supplier returns can now be opened via the bill's activity history.

You'll no longer get an error when trying to duplicate a quote which has been converted to an invoice.

MYE exports are no longer missing journals from the last day of the period being exported.

STP reports that contain only hourly wage pay items are now correctly sent to the ATO as a pay event instead of an update event.

The superannuation calculation for employees aged under 18 no longer includes previous pays.

Resuming a saved pay run now remembers the employees who were selected for the pay run when it was saved.

August

Employee self-onboarding

Send new employee self-onboarding requests via SMS

Enter a mobile phone number if you want to send your new employee a self-onboarding request via an SMS message as well as by email.

Single touch payroll

Easier previous year reporting

The Send update event button is now available for previous payroll years, so you no longer need to record a $0 pay to send updated information to the ATO.Improved instructions when setting up STP

When you're moving to STP Phase 2, it's clearer that MYOB Business is only showing how your ATO reporting categories are assigned for STP Phase 2, but not checking if they meet the ATO's requirements.

Also, if you're moving to MYOB from different software, it's now clearer that you only need to transfer your BMS ID if you've used the other software to report via STP in the current financial year.Easily see if you're on STP Phase 1 or 2

You'll now see which STP phase you're reporting on at the top of the screen in the STP reporting centre.More help available when finalising

Click the info icon on the EOFY finalisation tab to see details of what happens when you finalise an employee or remove their finalisation.

Sales

Edit customer note templates directly from invoices

You can now save any changes you make to customer notes while working on an invoice. Previously you could only do this in your sales settings.

Inventory

Export your items so you can update them in bulk

You can now export the details of your items. This is a quick way to bulk update your items by editing the exported file in Excel and importing the changes back into MYOB.Include freight costs in sales and purchases

There's a new Freight field in invoices, quotes, bills, purchase orders, supplier returns and customer credits to record associated freight costs.More streamlined item ordering

When you print or email a bill or purchase order, the Supplier item ID will appear on the PDF (if you've enter it in the item), making it easier for your supplier to identify their item.Quickly duplicate items

If you need to create similar items, duplicate an existing item then customise it as required.Always use the right account for your items

When adding an item to a sale or purchase, the income or expense account you've set for the item will always be used. If you need to change this account you'll need to do it in the item.

Tax codes

More flexibility in your Tax codes

You can now change the GST type in your GST codes.

Reports

Quickly see how much super your employees have accrued and how much you've paid

The Superannuation payments report shows the super amounts your employees have accrued in their pay runs, and the super amounts you've paid to their super funds. This is a great way to see any amounts you're yet to pay to a super fund.Smarter GST reporting

The GST report and GST return report are now automatically filtered according to the accounting method and frequency chosen in your GST report settings.Quickly see if there are consolidated or customised tax codes in your GST return report

You'll be warned that these tax codes won't be included in the report.All super payment details in one place

You can now click the super accrued and super paid amounts in the Superannuation payments report to see details of the associated pay runs and Pay Super transactions.Include inactive employees in the Superannuation payments report

When choosing the employees to show in the Superannuation payments report, you can now include inactive employees. This ensures that all superannuation records will be shown for the specified date range.More complete Pay run history report

The Pay run history report now shows pay runs that include pays and pay items that total to zero for the specified date range. The report now includes all relevant pay runs and only excludes pay runs where all the pay items are zero.Improved security

Users can now only see the reports they're permitted to see based on their user access settings.Find the right report faster

The search function in the reports list now looks at report descriptions and not just report titles.Consistent headings in exported reports

When a report is exported to PDF or Excel, the column headings match those shown in the report in MYOB.

Bug fixes

The chosen accounting method now displays correctly in the Balance sheet and Profit and loss reports.

Files exported for accountants no longer cause an out of balance when imported.

Fixed a bug that was causing incorrect year-to-date figures to show in STP reports for previous payroll years.

Fixed an issue in invoice and quote PDFs that caused the Unit column to be missing and the number of units and amounts for lines where the unit price is $0.

Fixed an issue that resulted in incorrect line amounts when changing the Tax inclusive/exclusive option and the tax rate was negative and larger than 100 (such as setting ABN tax code to -147%).

Tax amounts are no longer duplicated in the Customer sales (detail) report where an invoice has multiples lines.

Editing detail accounts no longer changes the parent header account. (AccountRight browser)

Fixed a bug that was causing STP Phase 1 figures to show in the YTD verification report for businesses who had moved to STP Phase 2.

Amounts no longer show more than 2 decimal places on the EOFY finalisation tab in the STP reporting centre.

July

Reports

Quicker payroll reconciliation

The Payroll advice report has been renamed the Pay run activity report and now includes:a grand total of pay amounts within the selected payment date range, showing totals for Gross pay, PAYG, Deductions, Net pay and Superannuation. This means you'll be able to match these amounts more easily against your bank statements. Filter by employee to see these totals for a single employee.

the ability to generate the report by Payment date or Pay period, giving you more flexibility when reviewing your employees' pay history.

Payroll

View past pay runs directly from your Dashboard

Click View pay runs on your Dashboard to open the Pay runs page, where you can see all of your past pay runs.Automatically keeping you compliant with super for under 18s

Employees aged under 18 who are paid weekly and have worked less than or equal to 30 hours in the week will no longer have super calculated in their pay.If you have inactive or terminated employees, you'll be compliant if you move to STP Phase 2

Inactive and terminated employees (paid in the current payroll year) will now be included in the employee details check when moving to STP Phase 2. You'll be prompted to send an update event after moving to STP Phase 2 to ensure the ATO has your employees' latest year-to-date payroll information. Also, whenever you send an update event, the year-to-date payroll totals for inactive and terminated employees (paid in the current payroll year) are now included.Identify negative ETP amounts more easily in STP reporting

The YTD verification and Summary of payments reports now show which ETP amounts are negative.

Banking

Quickly identify hidden bank feed transactions (AccountRight browser)

You can now view bank feed transactions you've hidden in your AccountRight desktop software.

Tax codes

It's easier to keep your tax codes list tidy

You can now delete tax codes that haven't been used in transactions, accounts, items or contacts. Find out more

Bug fixes

The Coding report no longer shows duplicates of some matched transactions. The totals on this report now match those on the Bank transactions page.

The Bank reconciliation report now shows the outstanding deposits and withdrawals, as well as the expected balance, for liability accounts like credit cards and loans.

Only the Advisor user from a practice will appear in the Users list after upgrading. Other users from that practice will now always be hidden if they have the same practice email domain name. (MYOB Essentials upgraders)

You can now export the Job profit and loss comparison report as a PDF or Excel file when you choose a single job or select the Consolidate jobs option.

If you invite another advisor with the same email domain, it will no longer be duplicated on the Users page.

When you create an item with the Buying price is option marked as Tax exclusive and include it in a purchase order it now calculates the price correctly.

June

Payroll

Keeping you compliant for the new payroll year

The tax tables have been automatically updated and will apply for pays dated 1 July 2022 onwards.Avoid mistakes when fixing termination payments

You'll now be prevented from entering negative Employment Termination Payment (ETP) amounts to fix a previously recorded ETP pay, and you’ll be prompted to reverse the incorrect pay instead. Learn about fixing ETPs.Helping you stay compliant with super for under 18s

If a pay run includes an employee aged under 18, an alert now appears advising you to check how much super you need to pay them. Learn about paying super for under 18s.Helping you automate the super rate increase

If you're currently paying 10%-10.5% super guarantee, when you do a pay run dated 1 July 2022 or later the new calculation basis of Minimum required rate will be automatically selected in your super guarantee pay items and the super amount will be updated to the new required minimum rate of 10.5%. You can also select this calculation basis manually if you need to. Once it's selected, any future rate increases will be handled automatically. Learn how to stay compliant with super increases.

Tax/GST codes

Easier to track the taxes that apply to your business

You can now create new tax codes (except consolidated ones) to suit your business needs. Find out more

Reports

More useful GST reporting. In the GST return report the W2 label now includes ETP tax withholding amounts. Also, if you've moved to STP Phase 2, the W1 label on the report now includes STP Phase 2 amounts.

Easier to read exported reports. If a report is exported to PDF and has more than one page, the column headings now appear on all pages. Also, wrapped text in longer columns will now start on a new page, to keep the related info together.

More efficient report packs. If a custom report is included in a report pack, the date range for the report pack is used for all reports in the pack – including the custom report.

Quickly identify if the exported Balance sheet is using the Cash accounting method. If you export the Balance sheet report for the Cash accounting method, the report will display Cash mode in the PDF or Excel file.

Contacts

Save time entering CC email addresses every time you email

You can now save one or more CC Email addresses in your customer and supplier contact records.Avoid errors when entering email addresses in contacts

If you accidentally put a space at the start of an email address, this will no longer cause and error. You'll quickly see if you've entered the same email address twice.

Sales

Keep your customer notes list free of duplicates

If you try to create a note that has the same note name or note text as an existing note, you'll see a message and won't be able to save it. This keeps your notes list easier to manage.

Bank transactions

Easier to match bank transactions

If a close match isn't found when matching a bank transaction, you can see other transactions you can match to without having to change the Show filter.

Bug fixes

Fixed an issue where the 3-letter code in an edited Tax code wasn't being saved as capitalised.

When you export the General ledger report, the option to display accounts with zero balances now works as expected.

Changes to the Description of transaction for an allocated bank transaction on the Bank transactions page are now saved.

When viewing transactions in the Balance sheet and Cash movement reports, super payment transactions are now displayed correctly in the Debit and Credit columns and are included in the ending balance.

The following changes have been made to the Year-to-date verification report in the STP reporting centre, making it easier to reconcile with the Payroll summary report when finalising your payroll

salary sacrifice amounts are now excluded from total salary and wages

reportable employer super contributions (RESC) and salary sacrifice amounts have been removed from STP Phase 2 W1 deductions

ETP taxable component amounts are no longer doubled for STP Phase 2

May

Superannuation

Helping you automate the super rate increase. A new option has been added to your super guarantee pay item to automatically increase the rate to 10.5% for pays dated 1 July onwards Understand your next steps...

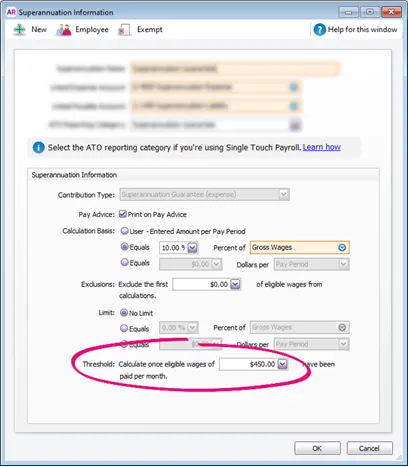

Simplifying super calculations. The $450 super earnings threshold is automatically removed from super calculations for pays dated 1 July onwards Learn more...

Helping you stay compliant with ATO super reporting. The correct ATO reporting category is now set as the default for all super guarantee pay items Learn more...

Sales

Send all your invoices at once

Select multiple invoices on the Invoices page and email them in bulk. This is great if you use recurring invoices or if you like to send your invoices in a batch on a particular day of the week.

Reports

Easier STP reconciliation. An STP Category column has been added to the Payroll activity and Payroll summary reports, so you can compare an employee's ATO reporting category amounts in MYOB Business to what's been reported to the ATO. The Payroll summary report also now has subtotals for each ATO reporting category.

Helping you avoid errors when running business reports. If you click an account total in the Profit and loss, Balance sheet or Cash movement reports and change the Date from field to before the opening balance date of your business you now receive a warning message.

Usability improvements

Know when you've reached the character limit in employee notes. The Notes field now prevents you from entering more than 255 characters, saving you time and effort redoing changes.

Bug fixes

Fixed an issue that made it possible to skip reporting a previous BMS ID (Business Management Software Identifier) when setting up STP Phase 2.

When you create a note in a new or existing invoice, unsaved changes to the invoice will not be lost.