Less apps, less taps.

Solo is the all-in-one mobile app for sole traders to manage admin and banking.

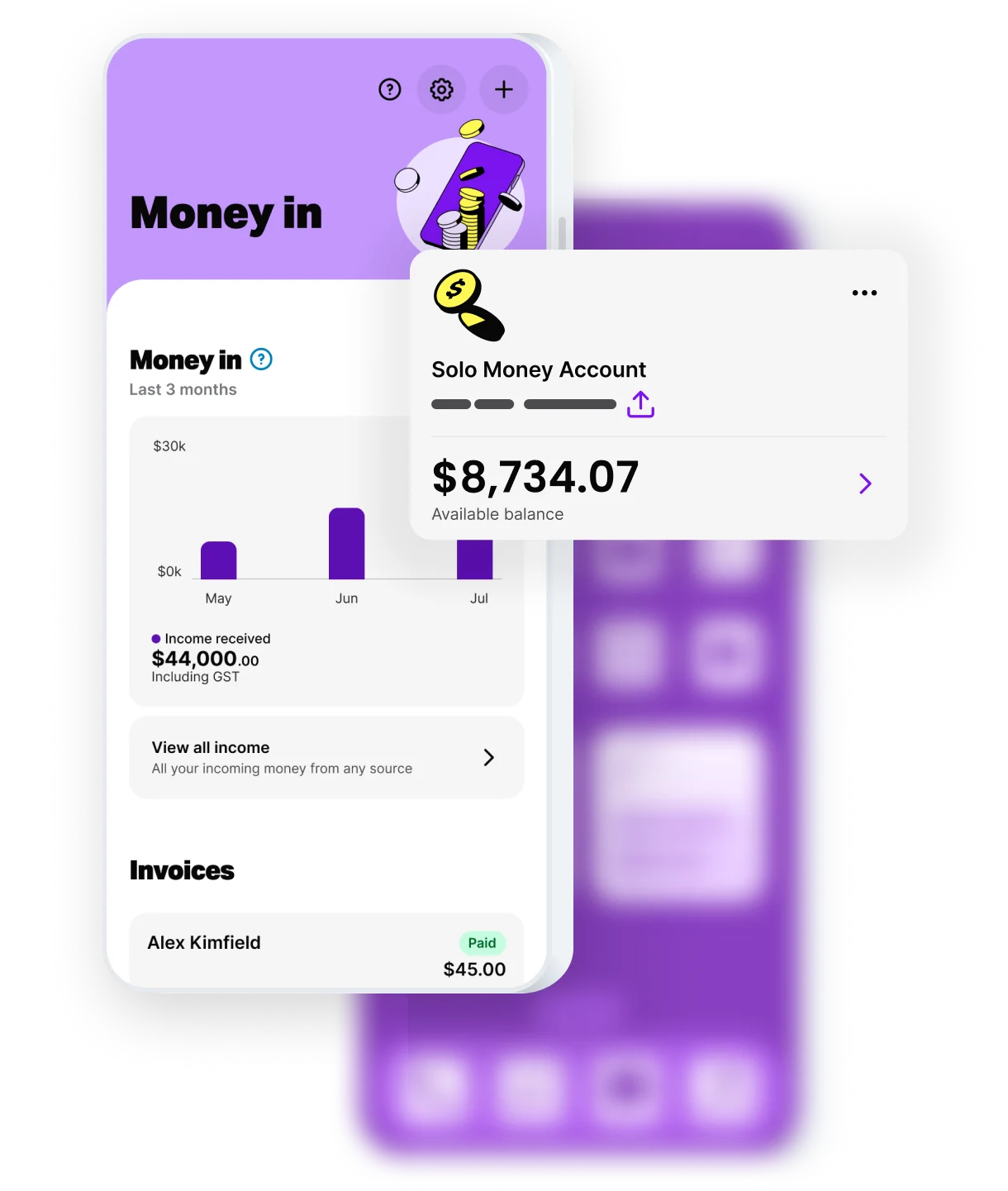

It’s free to set up a Solo Money business transaction account. Consolidate your numbers, auto-sort transactions, smart-match income and expenses, all in one place. Money tracked. Admin tackled.

Business and banking, without the back-and-forth.

Zilch. Nada. It’s free to start a Solo Money bank account.

Set up a Solo Money business bank account in minutes, for business banking in the Solo app.

✔ It’s free to open a Solo Money business transaction account

✔ To apply, you just need a valid ABN and proof of ID

✔ There are no ongoing account keeping fees

✔ Solo Money’s backed by one of Australia’s biggest customer-owned banks

You hold the cards.

Solo Money allows you to get paid, spend and track cash flow, all in one app. You can:

✔ Order a Solo Business Debit Card in seconds

✔ Set up Solo Money in your digital wallet – Apple Pay or Google Pay

✔ Make payments and transfer funds to and from your Solo Money account

✔ Set Solo Money as the destination for Tap to Pay, invoices and online payments

Banking and admin. Same app.

Keep your banking and admin in one place, for less guesswork on how much you earn and spend. With Solo Money, you can:

✔ Access near real-time income and expense smart-matching, just review and approve transactions

✔ Get automated expense categorisation, ensuring you're prepped for tax time

✔ View business income with cash flow graphs

One app. Banking and admin.

Say less.

Solo

The all-in-one mobile app for sole traders to manage admin, banking, and payments.

- Automated tax and GST tracking

- Create and send unlimited invoices

- Enable in-person payments with Tap to Pay

- Simple cash flow graphs

- Open an in-app Solo Money account

- Accept online payments

- Connect up to 2 existing bank accounts

- Snap and track expenses

Your questions, answered.

Who’s eligible to open a Solo Money business bank account?

You’ll need to meet certain eligibility criteria to apply for a Solo Money business bank account, including:

You must be a Solo customer

You must 18 years or older

You must be a Tax Resident of Australia only

Your business must have an active ABN

You must be registered as a sole trader, private company directly owned by individuals, or a partnership with only individuals as partners.

Which bank is Solo Money backed by?

The Solo Money business bank account is distributed by MYOB and issued by Great Southern Bank, one of Australia’s largest customer-owned banks, with over 75 years empowering customers on their financial journey.

What are the fees and charges for the Solo Money Account?

The Solo Money bank account is free to open and has no ongoing account keeping fees for active accounts.

Please refer to the Terms and Conditions for information about the fees and charges applicable to your Solo Money Account.

What identification do I need to open a Solo Money business bank account?

You must provide at least one of the following types of identification to open a Solo Money account:

Australian Driver’s Licence

Australian Passport

Medicare Card

I already have a business bank account, do I need to use Solo Money?

No, Solo offers flexible banking options. Want to connect existing accounts? Go ahead, you can connect up to two existing bank accounts to the Solo app.

Want to set up Solo Money? It’s free to open a Solo Money business bank account. You can apply in minutes.

The advantage of Solo Money is that bank transactions appear in near real-time, so you can review and approve income and expenses to keep your accounting organised.

What happens to Solo Money if I cancel my Solo app subscription?

If you have a Solo Money business transaction account, cancelling your Solo subscription does not close your Solo Money account.

You can continue to access Solo Money through the Solo app until your Solo Money account is closed.