Simple payroll software that won't break the bank

Save time with smart, flexible payroll management. Less admin for you, great tools for your team and automatic Single Touch Payroll reporting to the ATO.

Accurate, automated, easy-to-use payroll software

If you're looking for a better value payroll option for up to 4 employees. We think you’ll have zero regrets.

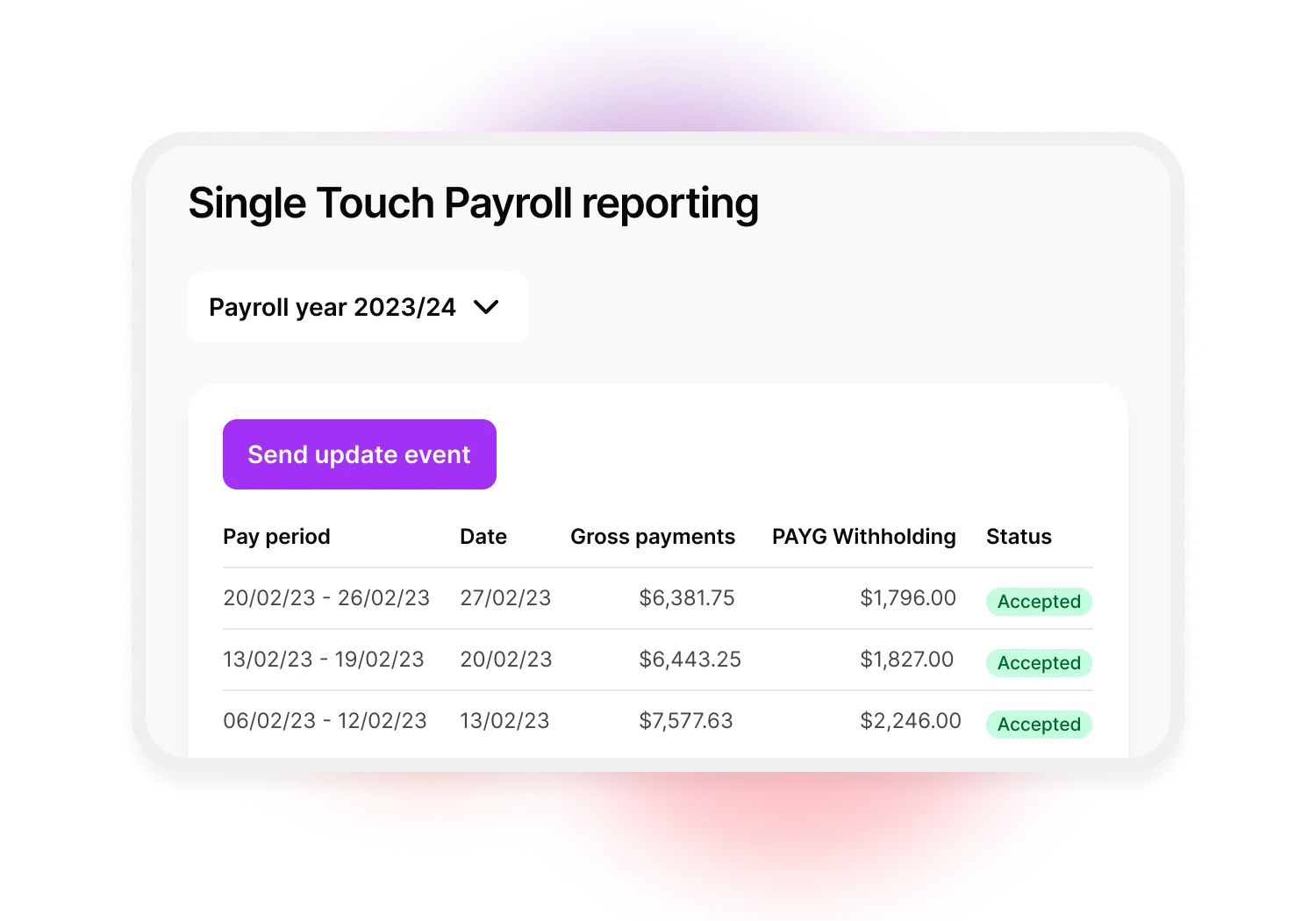

Single Touch Payroll, handled

Save time and stay in the ATO’s good books. With the click of a button, you can now generate and send Single Touch Payroll reports directly from your software to the ATO.

Feel confident you're up to date

Your software automatically updates in line with payroll and tax legislation, so you can be sure you're up to date and giving your employees everything they’re entitled to. Accurate and automated, just the way you like it.

Payroll compliance, simplified

Never second-guess if you've paid your employees the right amount. We'll handle the hard stuff and make it easy to apply the right award rates, penalties and loading entitlements to the right people.

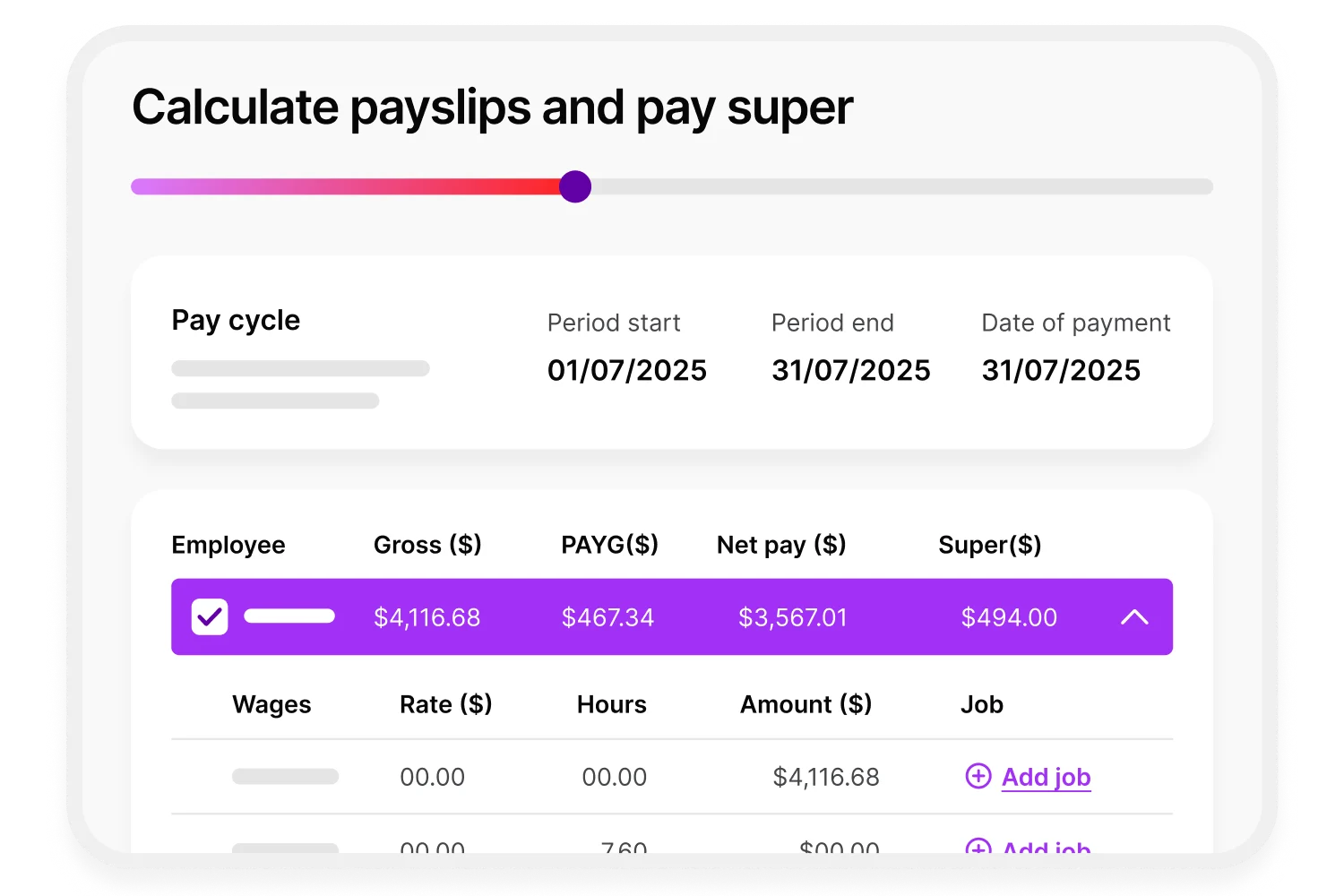

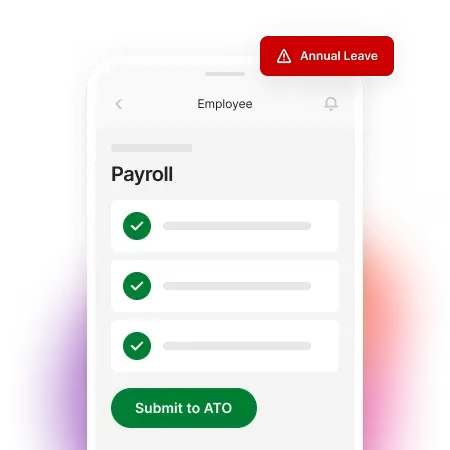

Calculate tax, leave and superannuation in just a few clicks

We’ll automatically calculate superannuation, tax, and annual leave so you can complete your pay run in 4 simple steps. We'll even alert you if something looks wrong, like extra annual leave.

Streamline your payroll process with MYOB

Payroll compliance, simplified

Avoid data entry and stay in the ATO's good books. Generate and send Single Touch Payroll (STP) reports directly from MYOB Business at the end of each pay cycle. You can rest easy for end of year reporting, and your employees can access their payroll information at any time.

Calculate tax, superannuation and leave in just a few clicks

MYOB Business automatically calculates superannuation, tax, annual leave and overtime. We stay up to date with regulations and will alert you if we see something that doesn’t look right.

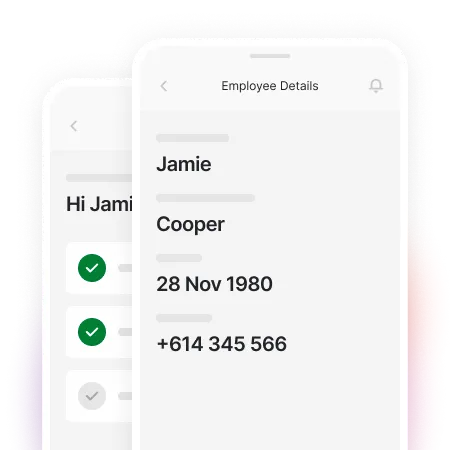

Onboarding? Let your employees self-serve.

Your team members can submit their bank, tax and superannuation details through our secure online form. Don’t worry about the filing cabinet, employee details and important documents like licenses and contracts are all in one place.

Get started with MYOB Business Payroll Only

MYOB BUSINESS

Payroll Only

For businesses that need standalone payroll for up to 4 employees

- Simple pay runs

- Direct reporting to the ATO

- Automated tax compliance

- Automated superannuation contributions

- Online employee onboarding

- Automated annual leave calculations

Manage your business on desktop or mobile

Access your information anywhere

Freedom to cancel at any time

All your questions about MYOB Business, Payroll Only, answered

What is Payday Super?

Currently, employers must make superannuation payments each quarter. Many businesses already pay super with each pay cycle.

From 1 July 2026, employers must pay super at the same time they pay wages or salaries.

For small businesses, this means adjusting to more frequent superannuation payments. Without the right systems in place, businesses risk becoming non-compliant, and significantly increasing admin workloads. With MYOB, however, these obligations can be met seamlessly as part of the payroll workflow.

Is there a minimum subscription period?

Nope. And there are no lock-in contracts either. Pay monthly (or yearly to save more) and enjoy the flexibility to cancel anytime.

How long does it take to set up MYOB Business Payroll Only?

Just a few minutes — honestly.

Choose the software plan that's right for your business

Sign up to access your software immediately

Log in to your software. Once you've logged in, we'll guide you through the set-up so you can spend less time on admin and more time doing what you do best.

Do I need to install MYOB Business Payroll?

MYOB Business Payroll Only is 100% web-based. No downloads required.

Can I change from MYOB Business Payroll Only to another plan later?

You sure can. If your business grows (congrats!) and you need software with more features like invoicing, expense tracking, or inventory you can upgrade your account in just a few clicks.

Can I use my account on my phone?

Yep, our software is compatible with all browsers on desktop, mobile and tablets.

Can I let other people access my software?

Absolutely. You can share your account with your advisor, accountant, bookkeeper or business partner at any time for no extra cost. You can also control what they can see and do by adjusting their access levels.

Is my data secure?

Yes. MYOB takes the security and protection of our customers’ data seriously. We use secure, encrypted channels for all communications between us and follow industry best practices including ISO 31000 Risk Management Standard.