Whether it's a pay rise or a pay cut, it's easy to update an employee's details in MYOB Business. The same process is used for hourly based and salaried employees.

If you're increasing an employee's pay and it needs to be back-dated, see back pay.

Go to Payroll > Employees.

Click the employee's name.

Click the Payroll details tab > Salary and wages tab.

Change the Annual salary or Hourly rate.

Click Save.

If you're changing an employee's hourly rate or pay cycle and it will affect the employee's standard pay hours, choose if you'd like to revert or keep their current standard pay hours.

Revert to default – reverts their standard pay hours to what's set in Hours in a pay cycle in the employee's record

Keep current – retains their standard pay hours, e.g. you've set this to 0 because the employee works varying hours (like a casual employee) and submits timesheets.

FAQs

What if I need to change an employee’s pay rate in the middle of a pay cycle?

Any rate changes you make in an employee's contact record will apply from the start of their next pay period.

If you need to change an employee's rate during a pay period, create a wage pay item called "Old pay rate" or similar and assign it to the employee.

When you then do your next pay run, edit the employee's pay to:

enter the hours/amount they worked on their old rate against the "Old pay rate" pay item, and

enter the hours/amount they worked on their new rate against Base Salary or Base Hourly.

How do I change an employee from full time, part time or casual?

Changes to working arrangements can be updated in an employee's record. This may include changes to pay rate, hours worked, and entitlements.

If the employee has unpaid leave which needs to be paid out, there may be rules around the payment of unused leave, so check with your accounting advisor if unsure.

You can then update the employee's payroll details to match their new working arrangement. See Adding an employee for help.

Check the rules with an expert

If you're not sure what an employee is entitled to under their new arrangement, the Fair Work website is a good place to start. You'll also find lots of experts on our community forum who are happy to provide advice on your situation.

Make a note of this change

Use the Notes field in an employee's record as a reminder of when you made this change (Payroll > Employees > click the employee > Contact details tab > Notes).

Whether it's a pay rise or a pay cut, it's easy to update an employee's details in AccountRight. The same process is used for hourly based and salaried employees.

If the employee's working arrangements are also changing, see Changing an employee from full time, part time or casual. Also, a pay rise might also mean the employee is owed back pay.

To see the hourly rate of all of your employees, run the Employee Employment Details report. See Payroll reports.

OK, let's step you through it:

To change an employee's salary or hourly rate

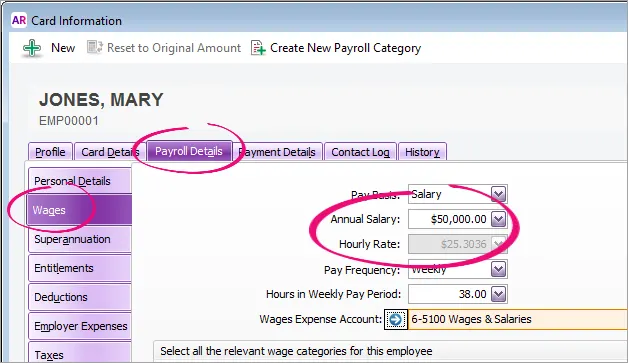

Go to the Card File command centre and click Cards List.

Click the Employee tab.

Click the blue zoom arrow to open the applicable employee's card.

Click the Payroll Details tab.

Click the Wages tab.

Change the employee's Annual Salary or Hourly Rate.

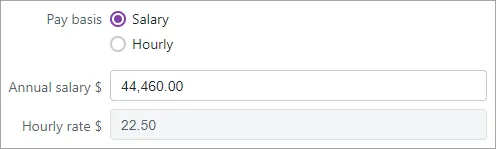

If an employee's Pay Basis is set to Salary, you can only change the Annual Salary value (the Hourly Rate is automatically calculated). Similarly, you can change the Hourly Rate for employees with a Pay Basis of Hourly.

Click OK.

If you're changing an employee's hourly rate or pay frequency and it will affect their standard pay hours, choose if you'd like to revert or keep their current standard pay hours.

Keep Current – retains their standard pay hours, e.g. you've set this to 0 because the employee works varying hours (like a casual employee) and submits timesheets.

Revert to Default – reverts their standard pay hours to what's set in Hours in...Pay Period in the employee's card.

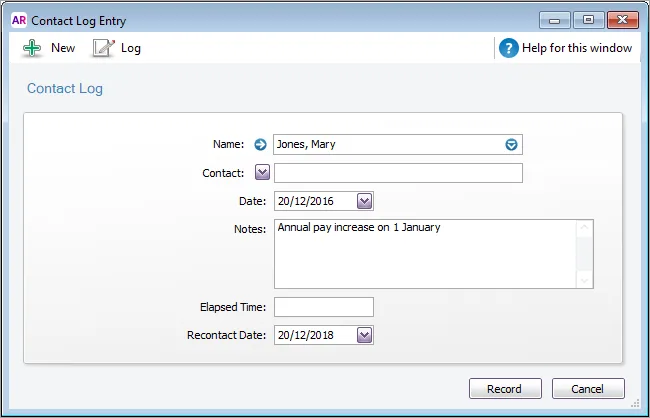

Set a reminder for an annual pay increase

If you have employees whose wage increases each year (say, on their birthday), create a contact log with a Recontact Date a few days before their birthday with a note to check pay rates.

The reminder will appear in the Contact Alert tab of the To Do List on the Recontact Date.

FAQs

What if I need to change an employee’s pay rate in the middle of a pay cycle?

Any rate changes you make in an employee's card will apply from the start of their next pay period.

If you need to change an employee's rate during a pay period, create a wage category called "Old pay rate" or similar and assign it to the employee.

When you then do your next pay run, edit the employee's pay to:

enter the hours/amount they worked on their old rate against the "Old pay rate" wage category, and

enter the hours/amount they worked on their new rate against Base Salary or Base Hourly.