MYOB's online payments reports are an excellent resource to see details of the payments you've received and fees you've paid for online payments.

You can access these reports via the Reporting menu > Reports tab > Online invoice payments tab. The reports and their functions are listed below.

Note that you need to be using online payments service to view these reports.

Transaction details

This report contains a summary of invoices and their settlement status, as well as details of the invoice payments that have already been deposited to assist reconciliation.

Click the Transaction details report from the Reporting menu > Reports tab > Online invoice payments tab.

Filter the report to see specific payments using these options:

Status – choose Settled money, Processing or Cancelled payments

Date type – choose Settled date or issued date then specify a date range using the From and To dates

Search by – choose Total amount, Invoice number or Invoice amount then enter Search text

If you're using a vertical display, click More filters to search.

Click Apply filters to show the filtered results.

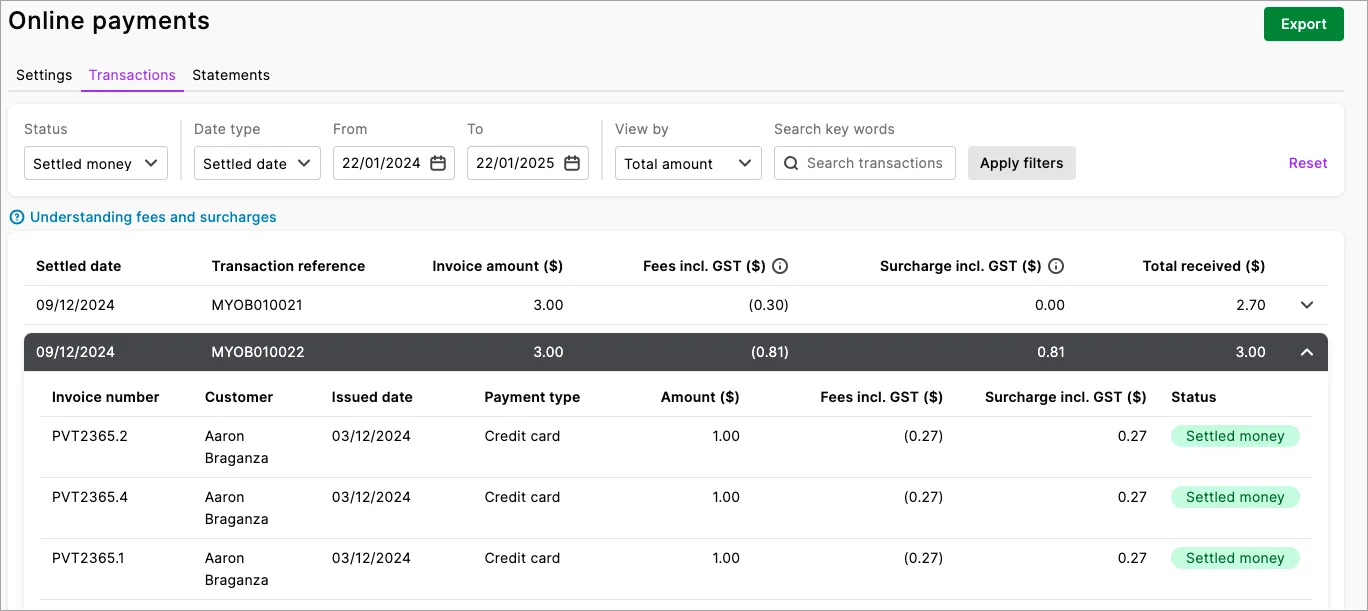

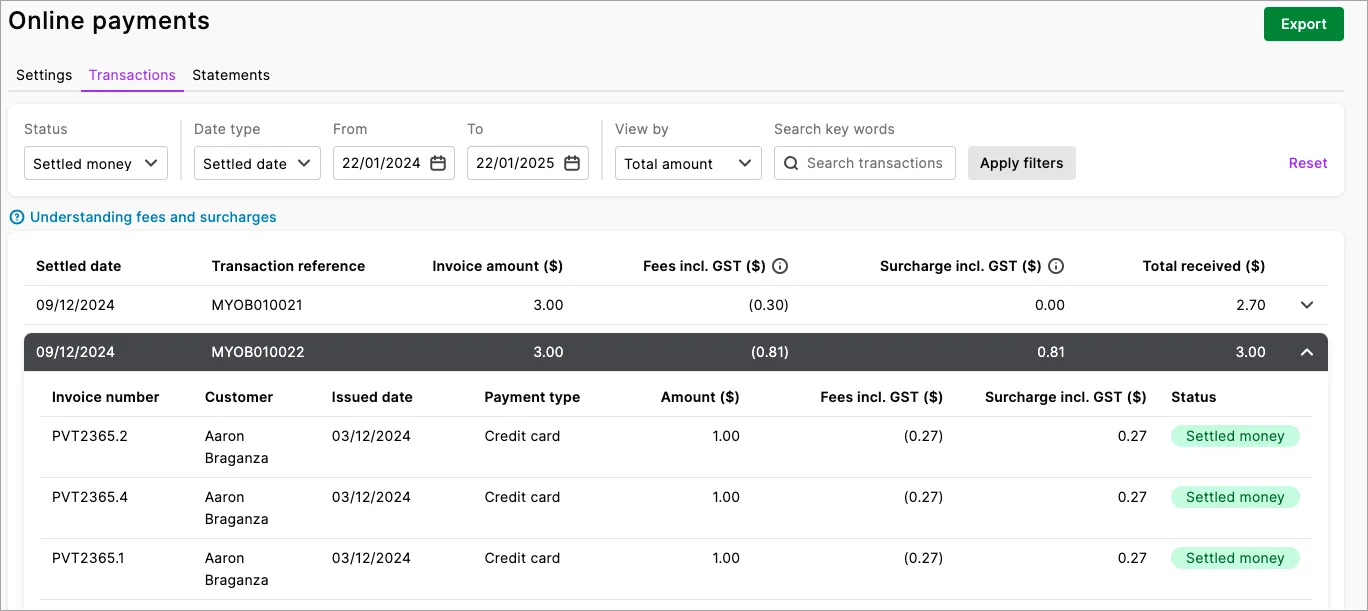

What the report shows

Settled date – shows the date the money was settled into your bank account

Transaction reference – the transaction reference number that will show on the transaction in your bank statement. This reference number will also show on the bank feed transaction if you use bank feeds

Invoice amount ($) – the total invoice amount. If multiple invoices are included it will be the total of all the invoices. This amount does not include the fees

Fees incl. GST ($) – the total fees incurred for the invoice(s)

Surcharge incl. GST ($) – the total surcharge paid by your customer(s). If the Fees incl. GST ($) are equal to Surcharge incl. GST ($) then all fees have been paid by your customer

Total received – the total amount settled into your account. This will be the total invoice amount minus the fees that were not surcharged to your customer(s)

Invoice number – the invoices that are included in the settlement transaction. If multiple invoices are listed this is considered a bulk payment

Customer – the customer who made the payment

Issued date – the date the invoice was issued to the customer

Payment type – the payment type used by the customer. This can be Credit card or BPAY

Amount ($) – the total invoice amount (does not include fees)

Status – the status of the invoice, e.g. Settled money, Processing

Exporting

You can export the report as an Excel spreadsheet or PDF by clicking Export. For PDFs, you can also choose which style template you want to use.

Note that you must enable editing of the spreadsheet from within Excel. If editing is disabled, the spreadsheet will not display the totals calculated in the report.

Transaction statements

This report is generated monthly and provides a summary of the fees associated with using the online payments service. It helps you track and account for these costs.

After a year of using online payments, you'll be able to access a rolling 12 months' worth of statements.

To open a statement, click the Transaction statements report from the Reporting menu > Reports tab > Online invoice payments tab and then click a month to open a PDF statement for that month.

MYOB's online payments reports are an excellent resource to see details of the payments you've received and fees you've paid for online payments.

You can access these reports via the Reports menu > Index to reports > Sales. In the Online invoice payments section, click View reports to display the reports in a web browser.

The reports and their functions are listed below.

Note that you need to be using online payments to view these reports.

Transaction details

This report contains a summary of invoices and their settlement status, as well as details of the invoice payments that have already been deposited to assist reconciliation.

Go to the Reports menu and choose Index to Reports.

Click the Sales tab.

In the Online payments section, click View reports then click Display Report. The report displays in a web browser.

On the Reports page, click Transaction details to open the Transaction details report.

Filter the report to see specific payments using these options:

Status – choose Settled money, Processing or Cancelled payments

Date type – choose Settled date or issued date then specify a date range using the From and To dates

Search by – choose Total amount, Invoice number or Invoice amount then enter Search text

Click Apply filters to show the filtered results.

What the report shows

Settled date – shows the date the money was settled into your bank account

Transaction reference – the transaction reference number that will show on the transaction in your bank statement. This reference number will also show on the bank feed transaction if you use bank feeds

Invoice amount ($) – the total invoice amount. If multiple invoices are included it will be the total of all the invoices. This amount does not include the fees

Fees incl. GST ($) – the total fees incurred for the invoice(s)

Surcharge incl. GST ($) – the total surcharge paid by your customer(s). If the Fees incl. GST ($) are equal to Surcharge incl. GST ($) then all fees have been paid by your customer

Total received – the total amount settled into your account. This will be the total invoice amount minus the fees that were not surcharged to your customer(s)

Invoice number – the invoices that are included in the settlement transaction. If multiple invoices are listed this is considered a bulk payment

Customer – the customer who made the payment

Issued date – the date the invoice was issued to the customer

Payment type – the payment type used by the customer. This can be Credit card or BPAY

Amount ($) – the total invoice amount (does not include fees)

Status – the status of the invoice, e.g. Settled money, Processing

The Transaction Description will appear in your bank feed description (or if you reconcile manually, in the bank statement) and in the bank deposit memo to help you identify your online payments when you're Reconciling your bank accounts.

Exporting

You can export the report as an Excel spreadsheet or PDF by clicking Export. For PDFs, you can also choose which style template you want to use.

Note that you must enable editing of the spreadsheet from within Excel. If editing is disabled, the spreadsheet will not display the totals calculated in the report.

Statements

This report is generated monthly and provides a summary of the fees associated with using the online payments service. It helps you track and account for these costs.

After a year of using online invoice payments, you'll be able to access a rolling 12 months' worth of statements.

To open a statement

Go to the Reports menu and choose Index to Reports.

Click the Sales tab.

In the Online payments section, click View reports then click Display Report. The report displays in a web browser.

On the Reports page, click Statements.

Click a month to open a PDF statement for that month.