The steps to complete the tax return.

Finalise data entry and validate, review and approve a tax return

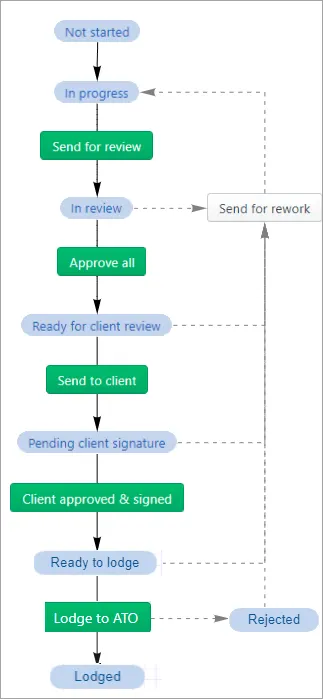

Tax return workflow

Tax returns and activity statements are grouped by different statuses:

Status | Description |

|---|---|

Not started | Tax returns/Activity statement that has been created but you haven't started working on it. |

Non-lodgable | This status only applies to a non-lodgable BAS (it's locked so you can't edit it). You don't need to lodge these forms unless you're varying the ATO calculated instalments. |

In progress | You're working on the activity statement or tax return. |

In review | Your work is being reviewed, either by a manager or a partner. When finished, approve the form to update the status to Ready for client review. |

Ready for client review | A manager or partner has approved the form. It's now locked and ready to send to the client. |

Pending client signature | You've asked the client to review and digitally or physically sign the form, and are waiting for them to approve it. |

Rejected by client | The client rejected the form. Click the link to find out more in the client task details. |

Ready to lodge | The client signed and approved the form, and it's ready to lodge. |

Processing lodgment | You've lodged the form to the ATO and we're waiting for a response. No action required. |

Rejected | The ATO rejected the form. Check the rejection code and fix the data. Re-validate and lodge the form. |

Failed to load | The ATO pre-fill failed and we can’t load the form. |

Lodged | Successfully lodged to the ATO. |