Cloud payroll software for small businesses

Save time with smart, compliant and flexible payroll management. Less admin for you, great tools for your team and automatic reporting to IR. Start your 14-day free trial today!

Streamline your payroll process with MYOB

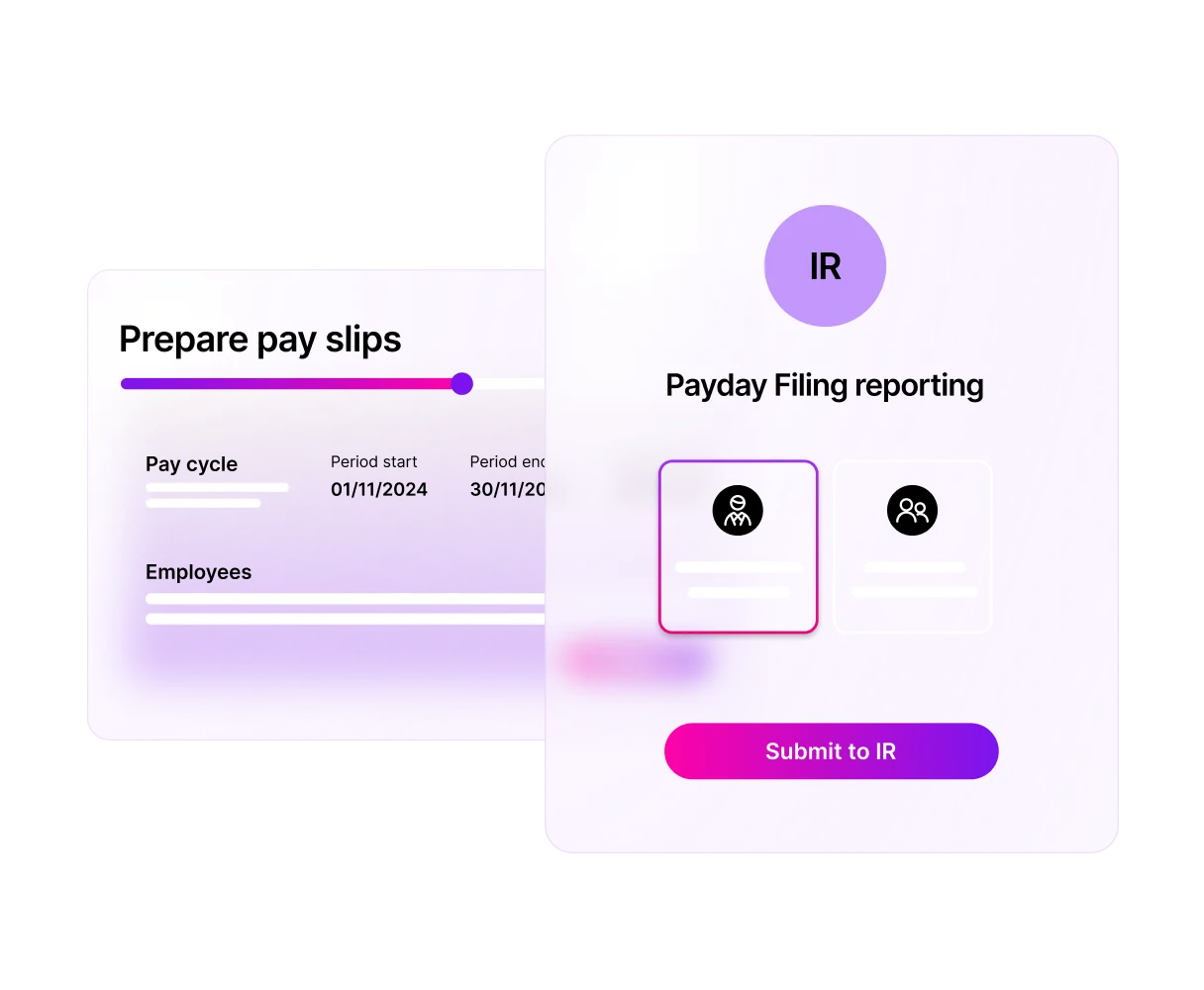

Payroll compliance, simplified

Stay in IR’s good books. Generate and send Payday filing reports directly from MYOB Business so you can rest easy. You can rest easy for end of year reporting, and your employees can access their payroll information at any time.

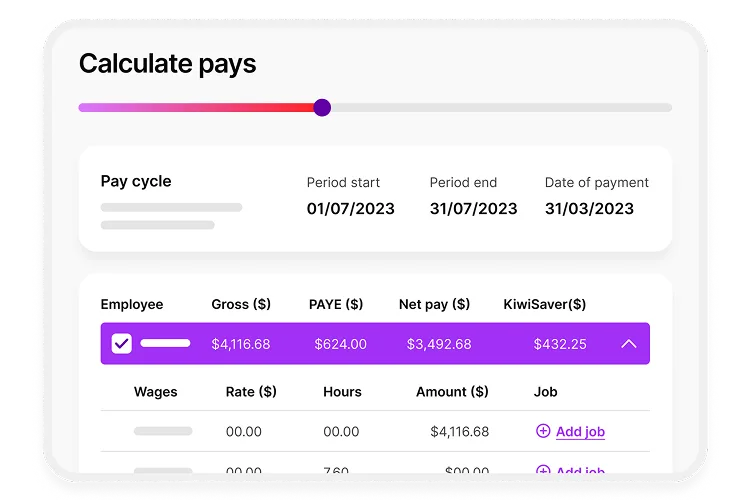

Calculate PAYE, KiwiSaver and leave in just a few clicks

With automatic KiwiSaver calculations and PAYE payments to Inland Revenue - you'll always know where you stand.

Only pay for what you use and need

As your business grows and adapts, so might your payroll requirements. Whether you employ one person or many, you’ll only be charged for who you pay each month.

What our customers say about MYOB cloud payroll software

Swipe left and right to see more

Current slide:00|Total slides:00

Need more than payroll?

Cash flow management

Keep money coming in steadily with tools to manage income, remove the guesswork from budgeting, and get paid faster.

Invoicing and quotes

Create and send professional invoices with customisable templates. Costs are automatically calculated using pre-saved data, and customer contacts are added instantly so invoices are ready to send fast.

Got more complex payroll needs?

All your questions answered about MYOB cloud payroll software:

Do I need to install any software?

MYOB Business Lite and Pro are 100% web-based. No downloads required.

How long does it take to set up MYOB payroll software?

To set up MYOB payroll software, all you have to do is:

Choose the plan that's right for your business

Sign up

Invite your employees to input their payroll details

Let the software calculate the hard stuff for you

How do I migrate from another payroll software to MYOB?

There are two ways to move your data to MYOB.

Option 1: Manage your own move

See our helpful guides:

Migrate from other software (Reckon, Xero or QuickBooks)

Option 2: Get help moving from Reckon, QuickBooks or Xero to MYOB

With the help of MMC Convert, our migration partner, you can have your data securely migrated from your current accounting software to MYOB. Plus, we'll cover the cost to migrate data from the current and previous financial year. Make the move.

Is my data secure?

Yes. MYOB takes the security and protection of our customers’ data seriously. We use secure, encrypted channels for all communications between us and follow industry best practices including ISO 31000 Risk Management Standard.

What is payroll software?

Payroll software helps you pay your employees. It automates processes like calculating pay, tax and annual leave. It also helps ensure that figures are accurate and follow legal and tax requirements.

Can payroll software integrate with accounting and invoicing tools?

Yes, MYOB Business Payroll integrates with other software, particularly its own accounting products like AccountRight and MYOB Acumatica. MYOB Business Payroll also integrates with various third-party applications, including HR, rostering, and timesheet software, and offers services to help migrate data from other systems like Xero and Reckon.

How do I use payroll software?

Each type of payroll software is different. Cloud payroll software, like MYOB payroll, follows a standard structure. It stores financial information about your employees and uses this to generate pay and annual leave. Simple!

How do I set up payroll in my MYOB software?

Setting up payroll in your MYOB software is simple, and takes 3 easy steps:

Set up payroll for your business – start by entering a few details about how payroll works in your business.

Set up employees – you'll need to set up each of your full-time, part-time and casual employees. New employees can submit their own details.

If you've already paid an employee this payroll year using different software, you can enter the amounts you've already paid them.Set up reporting obligations – you're almost done. The last step is to set up Single Touch Payroll reporting to ensure your information is reported correctly to the ATO. And finally, you'll set up the superannuation payments you'll contribute for your employees.

For detailed instructions, view our help page to set up payroll with ease.

Is there a minimum subscription period?

Nope. And there are no lock-in contracts either. Pay monthly and enjoy the flexibility to cancel anytime.