Four reasons why BankLink is a proven solution for rural clients

4th June, 2015

“Stressful! Disorganised and time consuming.”

That was life for beef and deer farmers Kate and Nathan Stratford before moving to MYOB BankLink.

“We didn’t really have a handle on what was happening, we had minimal formal budgets and didn’t know if we were moving forwards or backwards with our business”.

Fickle internet connections, lack of time, need for reliability, and (for the Stratfords) a need for financial visibility – these are some of the reasons New Zealand’s primary producers turn to BankLink as their preferred accounting solution.

Let’s take a look at how BankLink has earned its position as leader in rural accounting solutions.

1 – Breadth of rural data

BankLink pioneered the data delivery process and still provides the MOST accurate, secure and reliable rural data. It’s rich in detail, contains key information including quantities and livestock details on purchases and sales.

And even though the data is really complicated to stitch together and deliver accurately to accountants, our expert data team do it with ease.

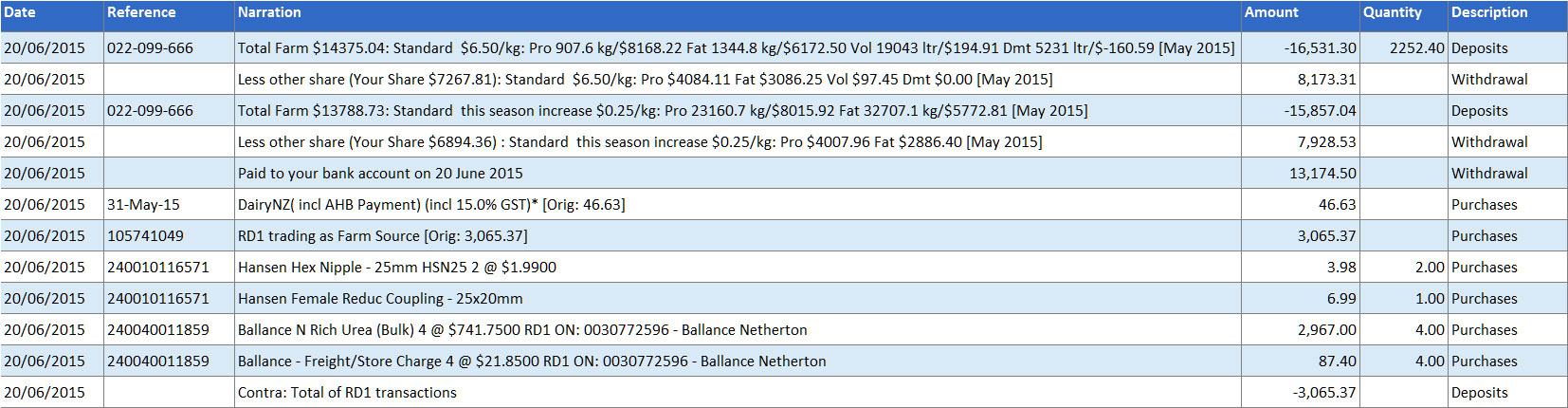

2 – Fonterra data

Leading on from point one, BankLink is the only service in New Zealand offering Fonterra milk supply information, combined with the Farm Source rural supplies business. So dairy farmers get a full view of their Fonterra transactions, not just a monthly lump sum amount in their bank account. And of course that means you the accountant get one consolidated view of your client’s business.

3 – The Internet

In this world of ever-evolving online industry, BankLink continues to be trusted in areas where the World Wide Web can be disrupted by the dreaded pop-up: limited or no connectivity.

Of course BankLink won’t be offline forever, as there are plans afoot to create an online version as well. But for rural clients, it’s peace-of-mind knowing that their BankLink service isn’t dependent on the vagaries of their telephone line. And the offline BankLink service will be around for a long, LONG time to come.

4 – Farming-specific tools

By providing key farming-specific rural data, you and your farming clients can produce highly detailed management reporting to make informed decisions. For example:

- Cashflow reports with this year / last year analysis (especially important with the cyclical nature of milking and farming in general)

- Budgeting capability that enables accurate, detailed actuals to budget information

- When selling or purchasing livestock, BankLink has data feeds with the leading agents that provides head count details in the itemised invoice.

I’ll leave the last word to Kate Stratford on the change that using BankLink has meant in her business:

“It takes a third of the time to do our books now. In around 30 minutes we can fill in a few stock numbers sold, code a few entries and email the file straight back to our accountant, while the reports keep us tuned in to exactly where all of our money is going.

“BankLink provides us cost savings and means spending less time on our accounts.”